|

These free reports, twice a month, are

useful, but to successfully trade market

trends you need our daily reports. At

half price they are an affordable and

valuable tool for creating profits in

the stock market.

Special

HALF PRICE Offer ---> CLICK

HERE NOW

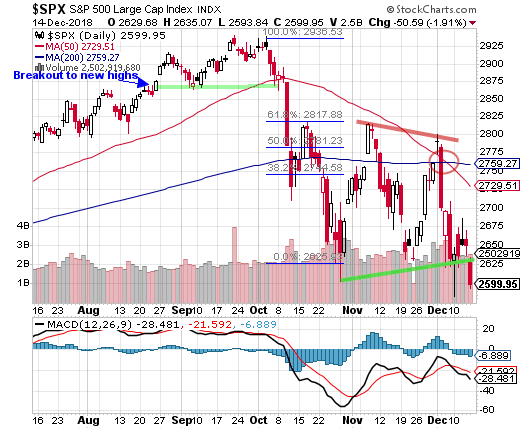

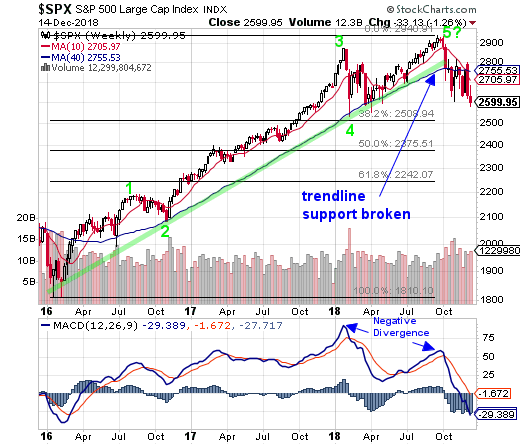

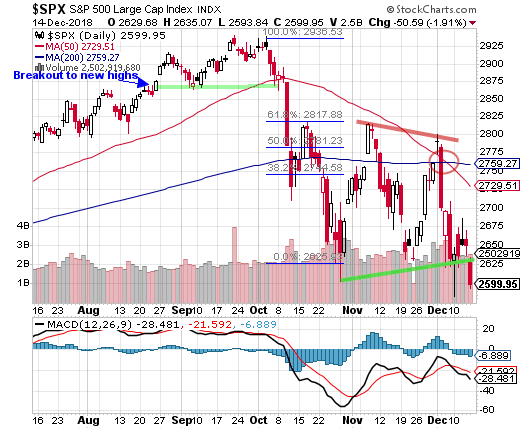

S&P

500 Index (SPX) Chart Analysis

Last week:

"This "death-cross" pattern

occurred weeks ago in the Russell 2000

Small Cap Index (RUT) and this week

in the Nasdaq 100 Index (NDX) charts."

This week:

Is a recession in the future? Hard to

ignore that possibility considering the

obvious stock market warnings. The stock

market looks ahead and today's prices

reflect what traders expect to happen

in future months.

The bearish patterns are increasing every

week.

Last week we added another bearish pattern

to the list. The extreme volatility over

the past weeks have created a pennant

pattern. This occurs when your rallies

reach lower highs and declines reach higher

lows.

This pattern, drawn on the below daily

chart of the SPX, is bearish if it occurs

after a downtrend. Typically, in this

scenario, the pattern breaks lower and

there are further losses.

On Friday of this week that pattern was

broken to the downside.

The other bearish patterns are:

A bearish divergence in the latest two

SPX highs on the daily chart and MACD

which did not make new highs.

There is a five wave pattern (Elliott

Wave) that ended in early October. If

this pattern has completed we are looking

at a decline, potentially, to SPX 2242.

The two-year long trend support line

has been broken.

The so-called death-cross pattern has

now appeared on all the major index charts.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports

are great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 284.2 % |

3

Year Results

Fibtimer Timing + 65.8 %

|

Sleepless

nights as your investments are

consumed by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend,

which ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

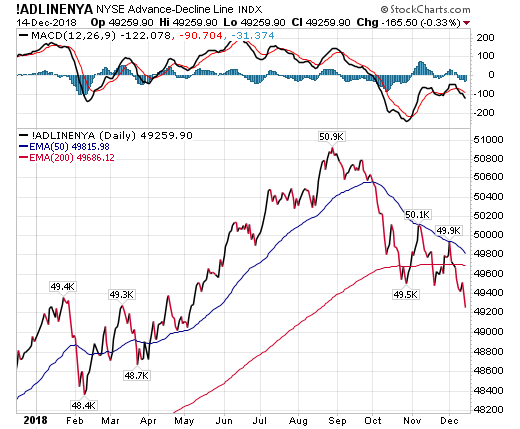

On Monday of this week the SPX rallied

into the close, ending the day in positive

territory, but the advances / declines

were terrible. Advancing stocks were

973 vs declining 2026. That by itself

was a warning that this week was going

to see losses.

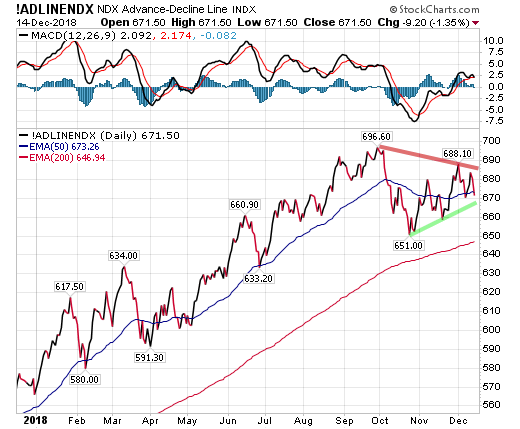

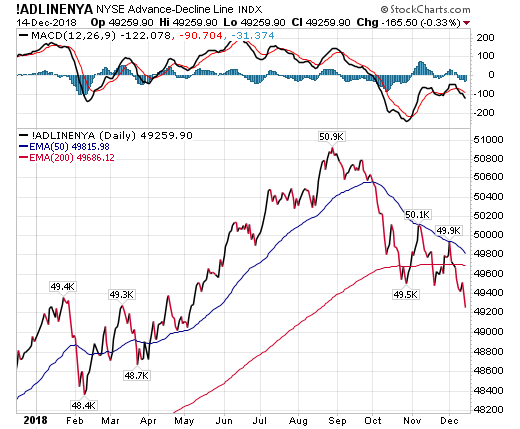

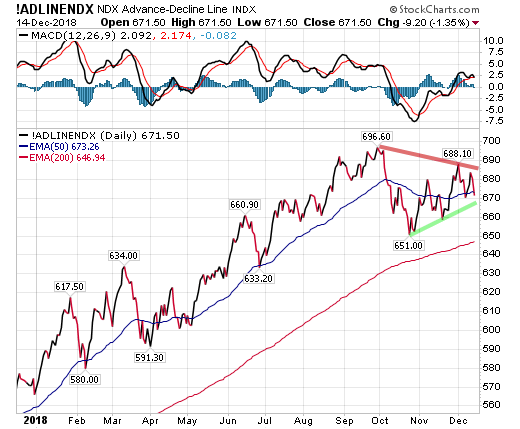

The Advance-Decline Line for the NYSE

Composite Index closed at new lows this

week.

The A-D line has now reached its 50-day

average line twice and both times reversed

and turned lower.

Ominously the A-D line closed below

its 200-day average line "again" this

week.

The A-D line also closed at "new" lows.

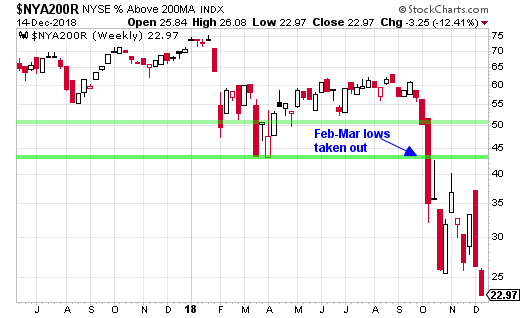

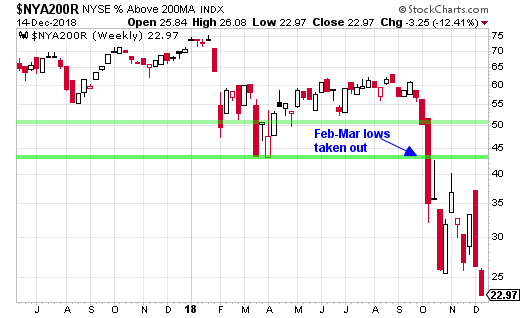

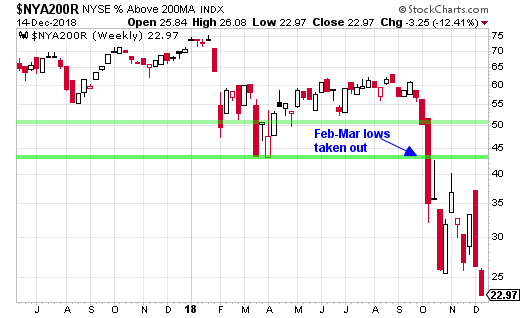

If you think breadth is bad in the above

A-D chart, look at the below chart of

the stocks in the NYSE (1600 issues)

that are "below" their 200-day

moving average line.

77.03% of stocks in the NYSE are trading

below their 200-day average lines

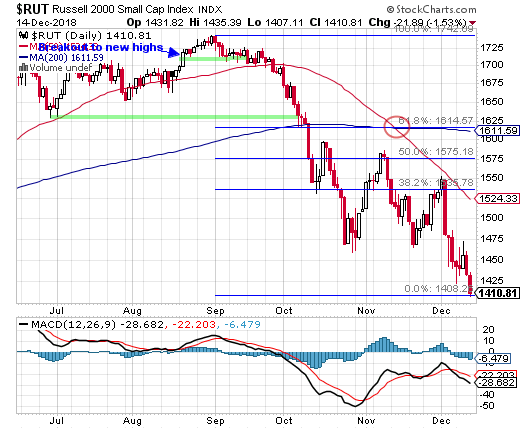

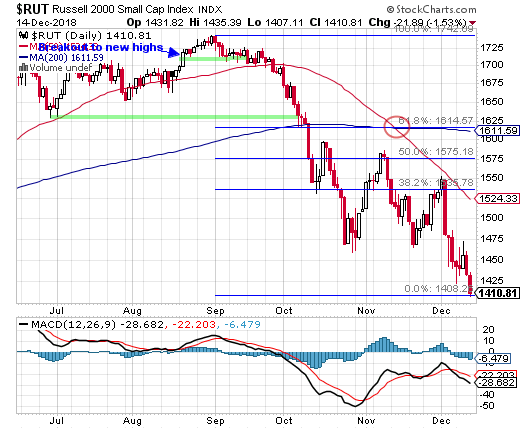

Look at small caps. They Russell 2000

Small Cap Index (RUT) has now lost -19.1%

since it hit new bull market highs in

the end of August.

And again this index broke down to new

lows this week.

Technically a bear market begins when

declines reach 20%. That is only 0.9%

further on this daily chart of small

caps.

We would have to say that small caps

are already deep into a bear market.

The 20% rule is fine but this chart is

extremely ugly.

Regularly

Followed Weekly Charts

NYSE Advance-Decline

Line

The NYSE A-D Line is not only below

its 200-day line but this week reached

a new low.

MACD has posted a bearish crossover

and remains in bearish territory for

the first time since March.

The A-D line reached its 50-day average

line twice in the past month during extreme

rallies. Both times it immediately reversed

lower.

Note that on each rally the A-D line

reached lower highs and on each decline

has reached lower lows.

The Nasdaq 100 Index Advance-Decline Line continues to do much better than

the NYSE A-D Line. MACD has crossed into bullish territory.

The Nasdaq 100 Index (NDX) itself is

one of the few major indexes that did

not make a new low this week. Though

it is trading at its lows.

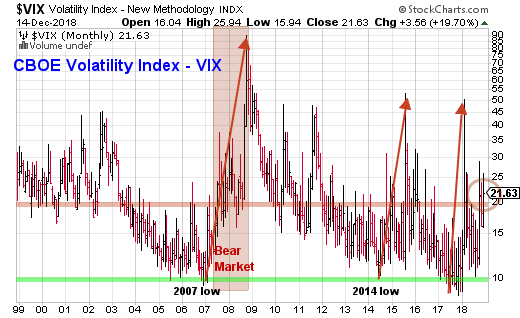

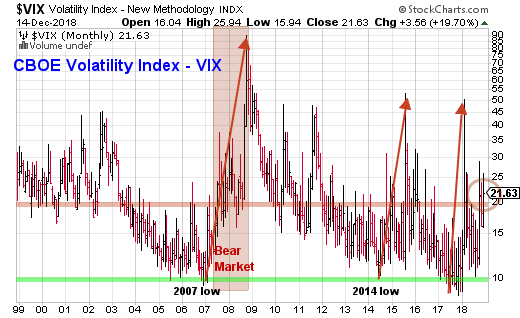

CBOE Volatility

Index (VIX)

The CBOE Volatility Index (VIX) is back

above the red line set at VIX 20.0.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 284.2 % |

3

Year Results

Fibtimer Timing + 65.8 %

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing the markets

successfully for over 25 years.

Join us and start

winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Considering the losses this week it

is surprising that VIX is holding at

21.63.

VIX is calling for continued volatility.

The uptrend has broken down.

Market Internals

The number of stocks trading above

their 200-day average closed at a new

low this week.

77% of stocks in the NYSE are trading "below" their

200-day average lines

Only 22.97% of stocks

in the NYSE are above their 200-day

average lines as of the close Friday.

Sentiment Indicator

This is a contrarian

indicator. Typically, when advisors

are mostly bullish, the markets are

often near a top.

Note that these numbers

are from a week ago. They reflect

the preceding week's sentiment.

The

number of bulls remains high. Remember

that those who are neither bullish

nor bearish have bullish positions

and really should be considered bullish.

Add bulls and those not specifically

bearish and you get 79.6%

with at least some bullish market positions.

Fibonacci Support

/ Resistance Levels

We are now looking at "support

levels" from the correction lows.

Fib support levels on the weekly chart

are as follows; the 38.2% retracement

support at 2508, the 50% retracement

support at 2375 and the critical 61.8%

retracement support at 2242.

Market Moving

Economic Reports Released this Week:

Job openings totaled 7.079 million

in November, up 1.7 percent vs 6.96

million in October and just shy of

August's record of 7.293 million. The

current number of openings is more

than 1 million above the number of

unemployed who have been actively looking

for work, at 6.075 million in a direct

comparison with October that since

fell to 5.975 million in last week's

employment report for November. The

number of job openings first broke

above the number of unemployed back

in April this year and have been inversion

ever since.

Optimism among small business owners

ebbed to the lowest level in 7 months,

according to the Small Business Optimism

Index, which fell 2.6 points in November

to 104.8, below the Econoday consensus

as well as the range of analysts' expectations.

More than half of the decline stemmed

from an 11-point drop to a net 22 percent

in expectations that the economy will

improve, and a drop in expected real

sales, which fell 4 points to a net

26 percent.

A jump in wholesale food prices and

traction in service prices offset an

expected drop in energy prices making

for a 0.1 percent increase in headline

producer prices for November which

is 1 tenth higher than Econoday's consensus

for no change. Ex-energy readings are

the key to today's report and show

steady and moderate pressure, at a

0.3 percent rise when excluding food

and energy and a 0.3 percent rise when

excluding food, energy and trade services.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 284.2 % |

3

Year Results

Fibtimer Timing + 65.8 %

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Same store sales were up 6.6 percent

year-on-year in the December 8 week,

extending the previous week's deceleration

from the strongest growth pace in over

12 years by another 0.4 percentage

points. Month-to-date sales versus

the prior month were down 0.5 percent,

matching the weakest reading since

the week of June 23, while the full

month year-on-gain shrank by 0.2 percentage

points from the prior week to 6.6 percent.

A sharp decline in interest rates

gave a boost to mortgage activity in

the December 7 week, with purchase

applications for home mortgages rising

a seasonally adjusted 3 percent from

the prior week and their year-on-year

unadjusted gain increasing by 3.8 percentage

points to 4 percent.

A mixed-to-soft consumer price report

for November won't be adding much rate-hike

pressure at next week's FOMC meeting.

The CPI came in as expected at no change

with the ex-food ex-energy core rate

also at expectations, up 0.2 percent.

Energy fell 2.2 percent in the month

with gasoline down 4.2 percent reflecting

the month's $20 drop in oil. Sharp

declines were also posted for apparel

at minus 0.9 percent, transportation

down 0.8 percent, and education/communications

down 0.5 percent. Housing, which is

the main component in the CPI, held

at trend with a moderate 0.3 percent

rise with medical care, another large

component, picking back up with a 0.4

percent increase.

Through October and November initial

jobless claims had been pivoting higher

off historic lows but that's old news.

In data for the December 8 week, claims

fell a very sharp 27,000 to a much

lower-than-expected 206,000 for the

best showing since the historic lows

of mid-September. For the first time

in five weeks the 4-week average is

down, 3,750 lower at 224,750 which

is still, however, over 10,000 higher

than early November.

A steep 12.1 percent drop in prices

of petroleum imports pulled total import

prices down a sharper-than-expected

1.6 percent in November. Yet there's

wider price weakness in the data. When

excluding petroleum, import prices

are still in the negative column, at

minus 0.3 percent in the month. Import

prices of finished goods, whether capital

goods, consumer goods, or autos, were

dead flat in the month with industrial

supplies, which often have petroleum

components, falling sharply.

Export prices likewise show weakness,

falling an unexpected 0.9 percent in

November despite a welcome 1.8 percent

price bounce for agricultural exports.

Export prices for industrial supplies

fell 3.0 percent in the month with

export prices for finished goods flat

to marginally negative in the month.

Sharp contraction in gasoline sales

held down November retail sales which

rose 0.2 overall and also 0.2 percent

when excluding autos. When excluding

autos and also gasoline, the strength

starts to show with a 0.5 percent gain

and when looking at the control group,

which excludes gasoline and several

other components that slowed in November,

sales really jump, up 0.9 percent in

a reading that ultimately defines the

strength of the results.

Big jumps for utilities and mining

more than offset a flat performance

at manufacturers to make for a 0.6

percent jump in November industrial

production. Utility output surged 3.3

percent in November following two months

of soft results tied to hurricane disruptions

while mining output, which sank sharply

in October, rose 1.7 percent.

December's initial PMI samples report

noticeably slowing rates of growth,

at a 53.6 composite flash for a roughly

1 point decline in November and the

softest showing since May last year.

Services make up the bulk of the composite

and the index here likewise fell a

point to 53.4 to indicate the slowest

rate of growth in 11 months. Output

and orders both slowed for this sample.

Conclusion:

The SPX dclined to a new low this

week with most of the losses occurring

on Friday when the index lost -1.91%.

The weakness in the breadth charts

continues. Both the NYSE A-D line,

and NYSE stocks trading below their

200-day averages, made new lows this

week.

The potential that we have finished

a two-year bullish 5-wave Elliott Wave

pattern (weekly chart below). If this

is correct, the decline that follows

truly could be substantial. The Elliott

Wave pattern is on the weekly chart

below.

If we close below the closing lows

reached in March, that would confirm

that the Elliott Wave pattern has ended.

The SPX portion of this

strategy is BEARISH. Aggressive traders

should be in CASH (money market funds).

S&P 500 Index (SPX) Daily Chart

S&P 500 Index (SPX), Weekly Chart

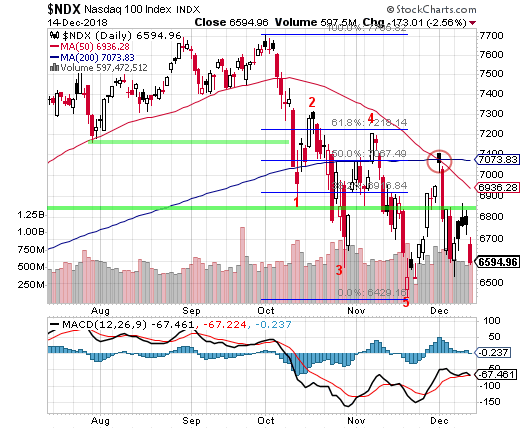

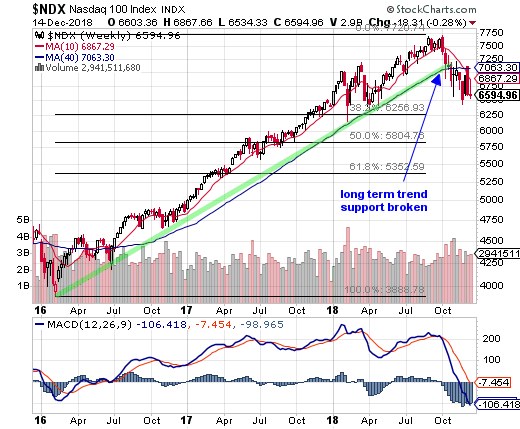

Nasdaq 100 Index (NDX) Chart Analysis

Last week we wrote:

"The Nasdaq 100 Index

(NDX) has completed a "death-cross" pattern

in both its daily and weekly charts."

This week:

The Nasdaq 100 Index (NDX) lost -2.56% on Friday

alone erasing all weekly gains. As mentioned

last week the NDX has also suffered a bearish "death-cross" pattern.

MACD on the volatile daily chart is now in bearish

territory and this week had a bearish crossover.

On the more stable weekly chart MACD has had

a steep bearish crossover and has closed in bearish

territory.

The NDX (chart) has held up better than the

SPX and considerably better than the small caps.

But still the tech index closed near its lows

and is now down -14.4% from its bull market highs

reached in September.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports are

great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 284.2 % |

3

Year Results

Fibtimer Timing + 65.8 %

|

Sleepless

nights as your investments are consumed

by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend, which

ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

We have posted Fibonacci retracement "support" levels

for the advance from the February 2016 lows. Those

Fib support levels (weekly chart) are; 38.2% at

NDX 6256, 50% at NDX 5804 and 61.8% at NDX 5352.

Conclusion:

As we wrote in the SPX analysis above, Monday's

very poor breadth that occurred as the market reversed

and rallied, was a bearish indicator for the rest

of the week.

Though the NDX tacked on some 69 points for the

day, there were only 1258 advancing stocks vs.

1854 declining stocks.

The NDX remains below its 200-day average and

last week had a so-called "death-cross" where

the 50-day average crosses below the 200-day average.

The NDX portion of this strategy

is BEARISH. Aggressive traders should be in CASH

(money market funds).

Nasdaq 100 Index (NDX), Daily Chart

Nasdaq 100 Index (NDX), Weekly Chart

|