|

These free reports, twice a month, are

useful, but to successfully trade market

trends you need our daily reports. At

half price they are an affordable and

valuable tool for creating profits in

the stock market.

Special

HALF PRICE Offer ---> CLICK

HERE NOW

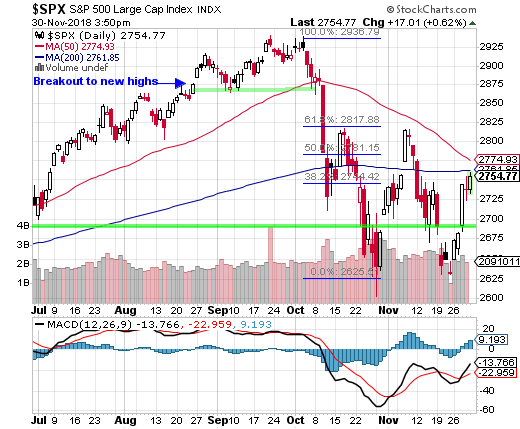

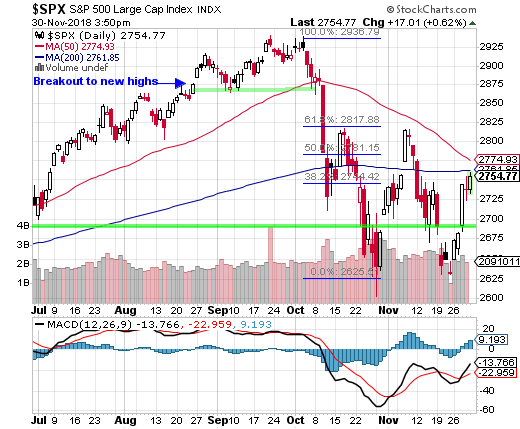

S&P

500 Index (SPX) Chart Analysis

Last week:

"The Thanksgiving

holiday week is historically a bullish

one. Not this time. After losses of

-1.7% and -1.8% on Monday and Tuesday,

the S&P 500 Index (SPX) took off

with a rally on Wednesday. At one point

nearing a 1.0% gain. But the selling

began midday and by the close, the SPX

was up only a fraction, and the Dow

actually closed with a loss after being

up as much as much +206 points."

This week:

It's hard to find something bearish about

a 2+% gain like we had on Wednesday. It

was not confirmed by a gain on Thursday

is one red flag, though we did get a rally

on Friday.

Wednesday's big rally was based on a

news event. You cannot know ahead of time

how a news event will affect the stock

market. If it was possible, the rally

would have occurred the day before.

News events do not usually change trends,

though if the event is big enough it could.

On Friday the SPX still did not close

above its 200-day average. Also, that

average is nearing a bearish crossover

by its 50-day average.

Yet the short-term trend is obviously

improving and our aggressive strategy

is moving back into bullish positions.

The question now becomes, is this the

type of market action that will take us

to new all-time highs and beyond: a so-called

Santa Claus rally?

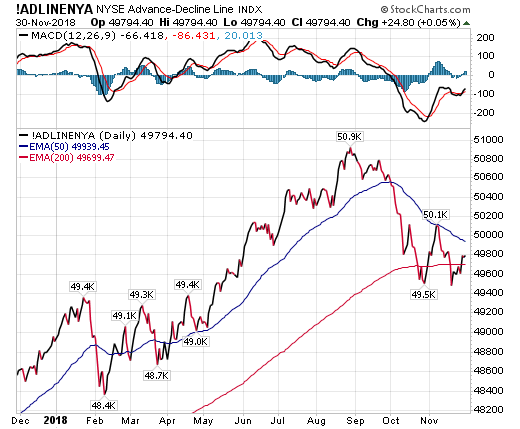

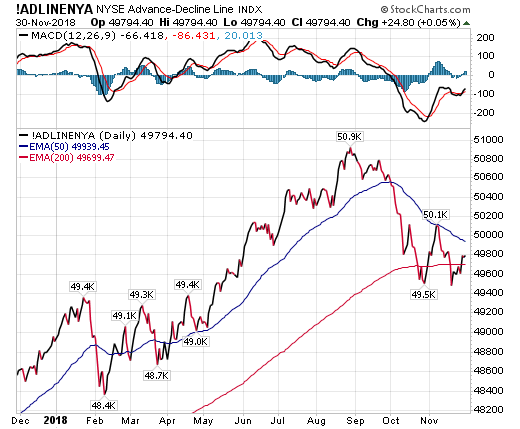

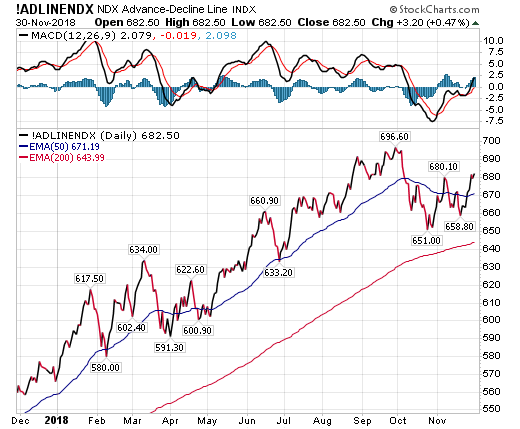

The Advance-Decline Line for the NYSE

Composite Index is not supporting the

current rally.

In fact it only just reached its 200-day

average line

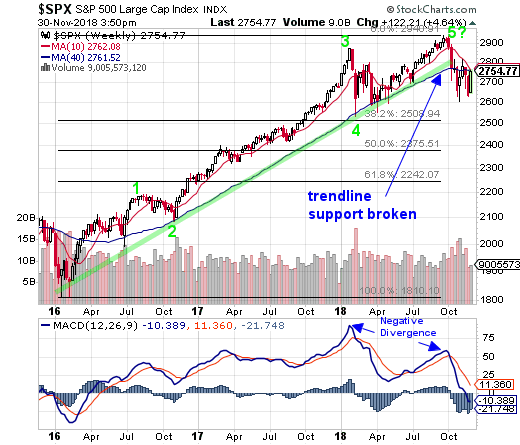

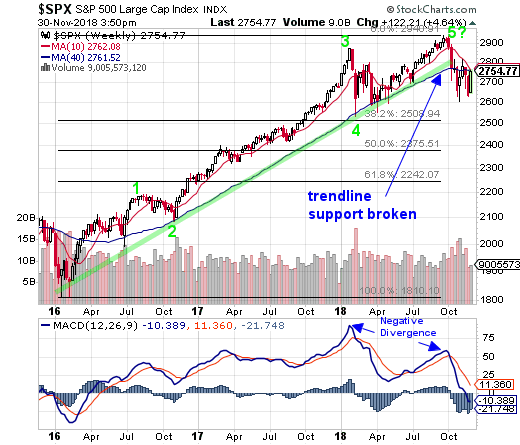

The weekly chart of the SPX has several

bearish patterns. We discussed them last

week and have them again here as they

are important.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports

are great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your investments are

consumed by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend,

which ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

1. There is a bearish divergence in

the latest two SPX highs and MACD which

did not make new highs. The weekly chart

shows the new high in the end of September

but a failure to make a new high in MACD.

2. There is also what looks to be a

bullish five wave pattern (Elliott Waves)

that ended in early October. If this

pattern has completed we are looking

at a decline, potentially, to SPX 2242.

Not instantly of course, but over coming

months.

3. The two-year long trend support line

has been broken.

Look at the increase in volume during

this decline and the lack of volume this

week on the upside. The SPX 2600 level

is where the February decline found support.

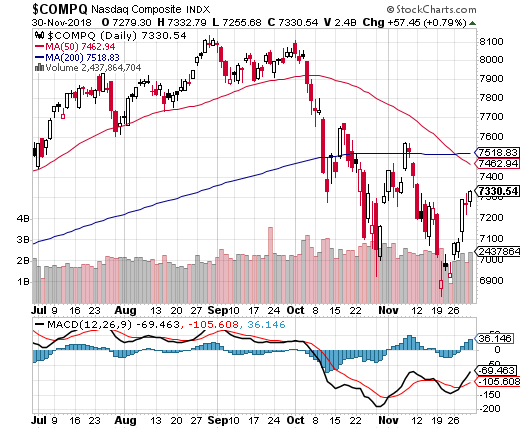

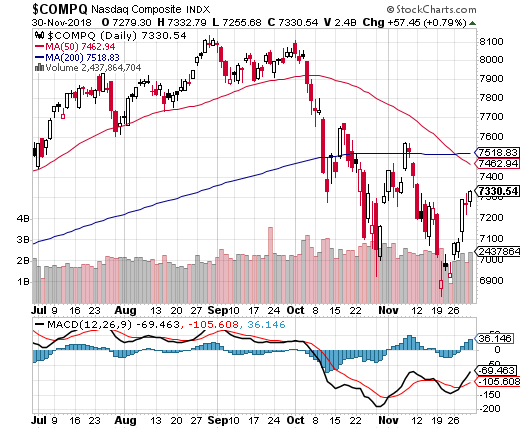

The Nasdaq Composite Index (COMPQ) had

a bearish so-called death cross when

the 50 day crossed below its 200 day

average.

This broader index now joins the Russell

2000 Small Cap (RUT) with a bearish death-cross

pattern.

According to data published Wednesday

by Goldman Sachs’ Portfolio Strategy

Research, the share of large-cap mutual

funds outperforming their benchmarks

fell from 63% in April to 33% through

the end of the third quarter

General Motors will lay off 14,700 factory

and white-collar workers in North America

and put five plants up for possible closure

as it restructures to cut costs and focus

more on autonomous and electric vehicles.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing the markets

successfully for over 25 years.

Join us and start

winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Regularly

Followed Weekly Charts

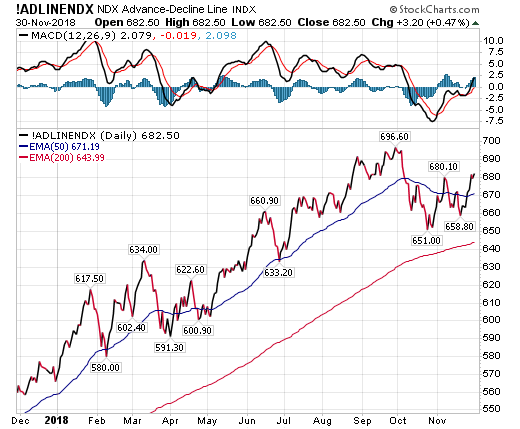

NYSE Advance-Decline

Line

The NYSE A-D Line managed to close

above its 200-day line.

MACD has posted a bullish crossover

but remains in bearish territory for

the first time since March.

The Nasdaq 100 Index Advance-Decline Line continues to do much better than

the NYSE A-D Line, this week moving back above its 50-day moving average

line.

MACD is rising and has crossed into

bullish territory.

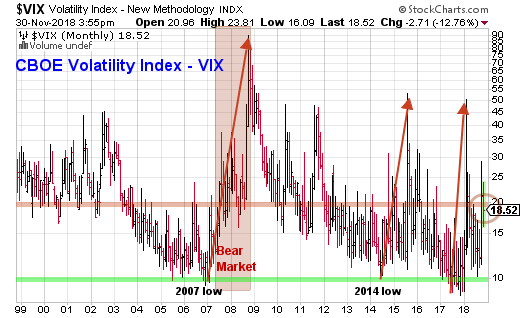

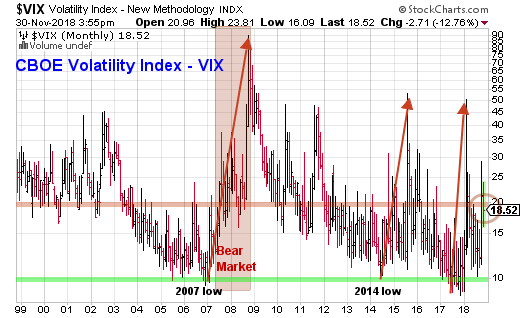

CBOE Volatility

Index (VIX)

The CBOE Volatility Index (VIX) is

back below the red line set at VIX

20.0. Not by much though, closing at

18.52.

VIX is calling for continued volatility

and appears to have not accepted this

week's rally as a new lasting trend.

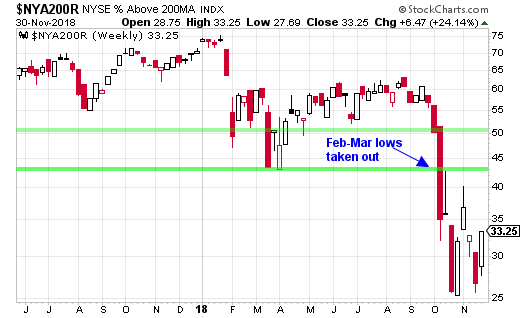

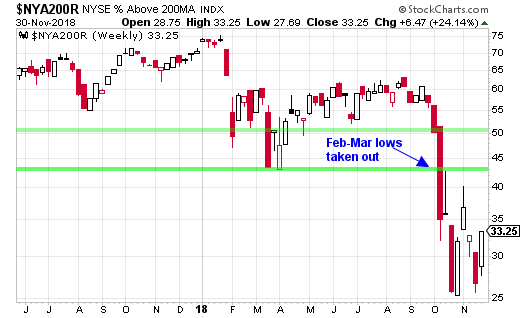

Market Internals

The number of stocks trading above

their 200-day average rose as expected

this week, but remains at very lows

levels.

The losses substantially exceed the

February-March selloff which is a worry.

Only 33.25% of stocks

in the NYSE above their 200-day average

lines is a disturbingly low number.

Consider that fully 66.75%

of the 1600 stocks on the NYSE are

now "below" their 200-day

line.

Sentiment Indicator

This is a contrarian

indicator. Typically, when advisors

are mostly bullish, the markets are

often near a top.

Note that these numbers

are from a week ago. They reflect

the preceding week's sentiment.

The

number of bulls remains high. Remember

that those who are neither bullish

nor bearish have bullish positions

and really should be considered bullish.

Add bulls and those not specifically

bearish and you get 79.4%

with at least some bullish market positions.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Fibonacci Support

/ Resistance Levels

We are now looking at "support

levels" from the correction lows.

Fib support levels on the weekly chart

are as follows; the 38.2% retracement

support at 2508, the 50% retracement

support at 2375 and the critical 61.8%

retracement support at 2242.

Market Moving

Economic Reports Released this Week:

Employment gave a sizable boost to

the national activity index in October

which rose to a higher-than-expected

0.24 vs Econoday's consensus for 0.20

and against a revised 0.14 in September.

Employment-related indicators contributed

0.19 to October's index vs only 0.05

in September as payroll growth more

than doubled to 250,000.

Same store sales were up 7.9 percent

year-on-year in the November 24 week,

sharply accelerating by 1.7 percentage

points to the strongest annual growth

pace in at least 12 years. Month to

date sales versus the prior month were

up 0.8 percent, while the full month

year-on-year gain rose to 6.7 percent,.

Case-Shiller's 20-city index posted

a moderate and expected 0.3 percent

monthly rise in September though the

unadjusted year-on-year missed Econoday's

consensus, moderating by 4 tenths to

5.1 percent vs expectations for 5.3

percent. The year-on-year rate, along

with FHFA's 6.0 percent rate also posted

this morning, are at roughly 2-year

lows.

The FHFA house price index edged only

0.2 percent higher in September for

the weakest showing since March this

year and missing Econoday's consensus

by 1 tenth. The year-on-year rate,

at 6.0, slipped 3 tenths from August

for the softest showing since January

last year.

The consumer confidence index, at

135.7 in November, continues to hold

in the mid-130s area and not far from

the all-time high of 144.7 reached

in 2000. November's strength is in

the present situation which is a favorable

indication for holiday spending, at

172.7 for an 8 tenths gain from October.

Expectations, however, eased by 4.1

points to 111.0 as optimism over future

job and income prospects is easing

slightly.

New-home sales ran at a seasonally

adjusted annual 544,000 rate in October,

the Commerce Department said Wednesday.

October’s selling pace for new

single-family homes was 8.9% lower

than September’s, although that

report was revised upward.

A downtick in mortgage rates spurred

homebuyers in the November 23 week,

with purchase applications rising a

seasonally adjusted 9 percent from

the prior week to lift their unadjusted

level back into positive year-on-year

territory, 2 percent higher than in

the same week last year.

Two wildcard components are slightly

more exaggerated in the third quarter's

revised GDP data while readings on

the consumer and housing are mixed.

At the headline level, the second revision

to third-quarter GDP is unrevised at

a very strong 3.5 percent annualized

growth rate but inventories, contributing

2.27 percentage points to the total,

added a little more than the first

revision while net exports, subtracting

1.91 points, pulled down GDP by a little

more.

After-tax corporate profits rose a

year-on-year 5.9 percent in the third-quarter

to $1.976 trillion without inventory

valuation and capital consumption adjustments.

When including inventory valuation

and capital consumption adjustments,

pre-tax corporate profits rose a year-on-year

10.3 percent to $2.318 trillion with

after-tax profits at $2.074 trillion

for a 19.4 percent gain.

U.S. pending home sales slid 2.6%

to a reading of 102.1 in October from

104.8 in September, the National Association

of Realtors said Thursday. That was

the lowest since June 2014. NAR’s

index, which tracks real estate contract

signings, was down 6.7% compared to

a year ago.

Initial claims are up for a third

straight week, 10,000 higher in the

November 24 week to a 234,000 level

that is outside high estimates for

228,000. The 4-week average is up a

sizable 4,750 to 223,250 which is suddenly

the highest reading since July. There

are no special factors distorting today's

report.

Conclusion:

The SPX posted a solid rally this

week completely erasing the prior week's

losses.

Yet the SPX was not able to close

above its 200-day moving average line.

The weakness in the breadth charts

continues. Both the NYSE A-D line and

the NYSE Stocks trading above their

200-day averages are near their lows.

The potential that we have finished

a two-year bullish 5-wave Elliott Wave

pattern (weekly chart below). If this

is correct, the decline that follows

truly could be substantial.

Last week we wrote: "Could

we see a rally? Certainly. An oversold

stock market can rally at any time.

But the bearish indicators are such

that any rally will likely reverse."

This week we had that rally and this

aggressive strategy will enter a bullish

position on Monday. When the traded

index reaches breakout level we will

trade it.

The SPX portion of this

strategy is BULLISH. Aggressive traders

should be in the Rydex Nova S&P

500 Fund - RYNVX (or other bullish

S&P 500 index fund or ETF such

as SPY or RSP

S&P 500 Index (SPX) Daily Chart

S&P 500 Index (SPX), Weekly Chart

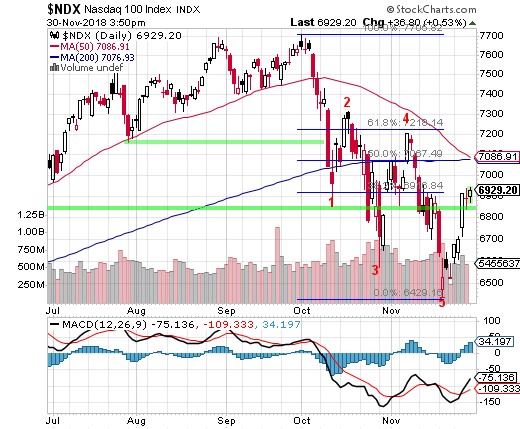

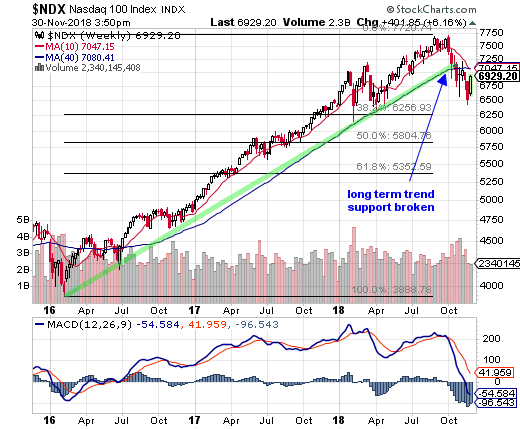

Nasdaq 100 Index (NDX) Chart Analysis

Last week we wrote:

"The Nasdaq 100 Index

(NDX) has closed at a new low since the selling

began back in early October. The NDX is down

over 1170 points and 15.2% since early October.

The index was down -4.95% this week alone and

-7.4% in the last two weeks."

This week:

The Nasdaq 100 Index (NDX) rallied this week

completely erasing the prior week's losses.

Interestinly, the weekly chart of the NDX posted

a death-cross pattern when the 50-day average

has closed below the 200-day average.

Yet the daily chart, while close, did not have

the pattern. Next week will likely resolve this.

MACD on the volatile daily chart is now deep

in bearish territory but had a bullish crossover

this week.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports are

great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your investments are consumed

by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend, which

ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

On the weekly chart MACD has had a steep bearish

crossover and has closed in bearish territory.

We have posted Fibonacci retracement "support" levels

for the advance from the February 2016 lows. Those

Fib support levels (weekly chart) are; 38.2% at

NDX 6256, 50% at NDX 5804 and 61.8% at NDX 5352.

Conclusion:

We have what looks like a bearish double-top in

the NDX on the daily chart. The index closed at

a new correction low last week but reversed and

erased all that week's losses.

A strong rally by any measure.

Yet the NDX remains below its 200-day average

and as we wrote above, is threatening a death-cross

pattern.

The gain this week has triggered buy signal for

this aggressive strategy.

The NDX portion of this strategy

is BULLISH. Aggressive traders should be in the

Rydex NDX 100 Fund - RYOCX (or other bullish NDX

100 index fund or ETF such as QQQ).

Nasdaq 100 Index (NDX), Daily Chart

Nasdaq 100 Index (NDX), Weekly Chart

|