|

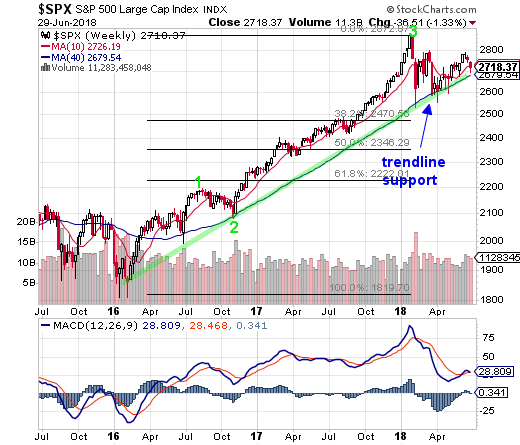

S&P

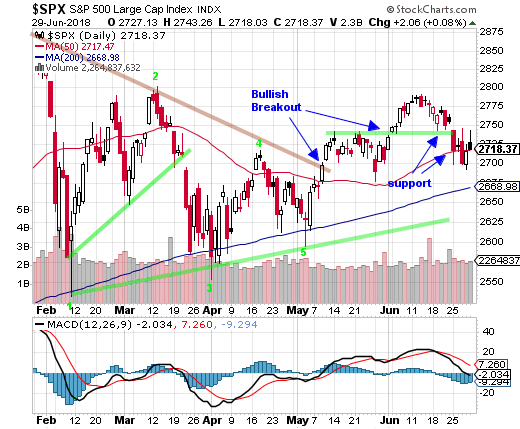

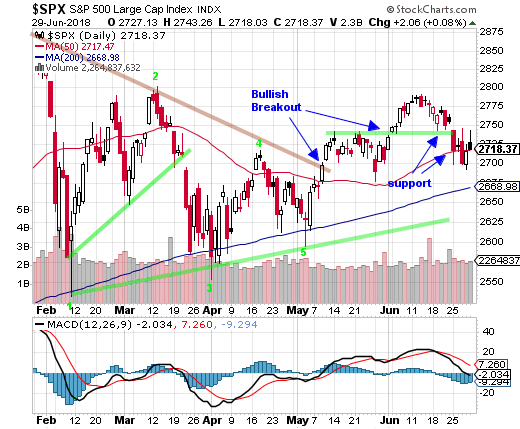

500 Index (SPX) Chart Analysis

Last week:

"Currently, 70.34%

of S&P 500 components are above

their 50-day moving averages. Last week,

this ratio hit 75%, which represented

the highest such reading since late

January, when major indexes last hit

records."

This week:

The 50-day moving average appears to

be key for this pullback. The S&P

500 Index traded below initial support

(horizontal green line) and then reached

its 50-day average line and closed the

week right at that line.

On Wednesday the SPX and most of the

major indexes rallied back up to that

initial support line but then collapsed

and closed below the 50-day line. Wednesday

was a bearish outside reversal day.

These occur when the market trades higher

than the previous day's highs and then

closes lower than the previous day's lows.

Very bullish intra-day sentiment is suddenly

reversed and all the gains are erased.

Though that reversal day was followed

by gains on Thursday, Another rally on

Friday also collapsed and most of the

early gains were erased. On Friday the

SPX closed lower than it opened.

Last week we wrote: "This does

not mean we are at a top as records

are broken all the time, but it does

mean we need to follow all sell signals

immediately. One of them could be the

one that is the start of a bear market."

The end-of-day selling on Friday was

a bit ominous. This comes after the bearish

outside reversal day on Wednesday and

investors have the entire weekend to think

about it.

That said, the July 4th week is usually

a bullish one. Obviously if a typically

bullish holiday week does not end with

gains, that would likely point to lower

lows ahead.

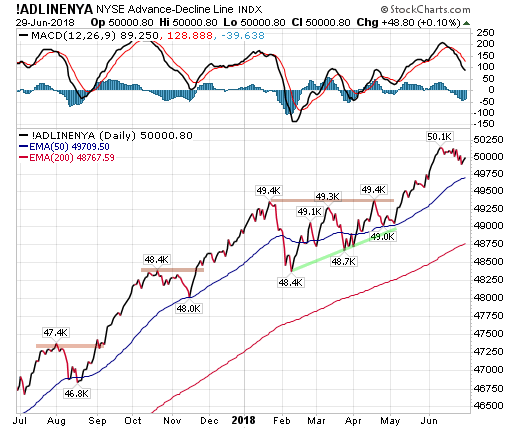

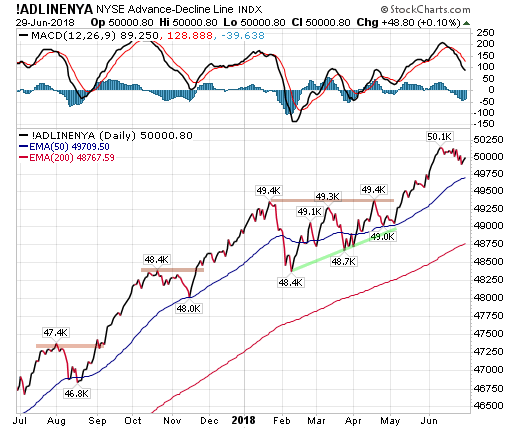

Another bearish indicator and possibly

the most important is the NYSE Advance-Decline

Line. Last week we wrote that the line

had turned lower but a single bad week,

while a concern, did not point to lower

lows.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports

are great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 291.4 % |

3

Year Results

Fibtimer Timing + 67.8 %

|

1

Year Results

Fibtimer Timing + 29.1.%

|

Sleepless

nights as your investments are

consumed by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend,

which ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

This week the A-D line closed lower

again. Support is at the 50-day average

for this indicator.

MACD is headed lower having made a bearish

crossover three weeks ago.

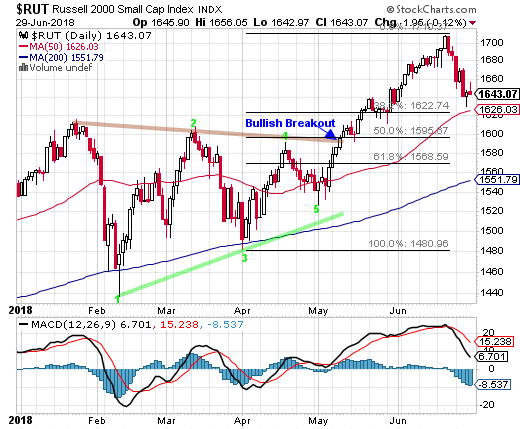

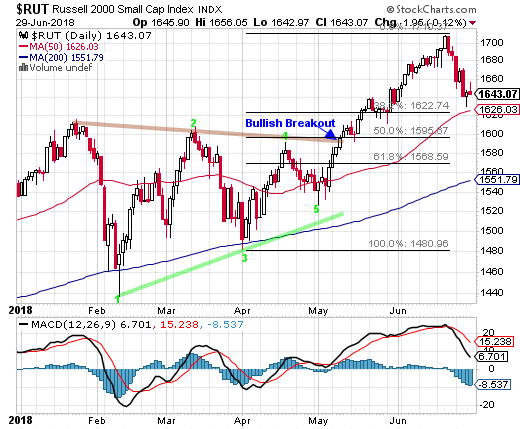

A big concern is small caps which have

been leading the stock market advance

since early May.

Small caps hit new bull market highs

two weeks ago but the sector sold off

during the last seven trading sessions.

Small caps did bounce off their 50-day

average line which is good, but they

also suffered that rally reversal on

Friday that took a gain and turned it

into a loss to end this week.

Small caps lost a whopping -2.52% for

the full week, though our small cap strategy

posted a nice +9.2% sell signal gain

for the preceding advance.

Well respected market technician Ralph

Acampora stated he is very concerned

about recent stock market actions.

He says that the bullish dynamic in

equities may be unraveling. That is particularly

the case after the Dow DJIA, -1.26% for

the week closed below its 200-day moving

average for the first time since June

2016, and as key components of the blue-chip

benchmark spiraled lower.

There are many big-players who will

see this break of the 200-day line as

a sell signal and who will be watching

Monday's trading closely.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 291.4 % |

3

Year Results

Fibtimer Timing + 67.8 %

|

1

Year Results

Fibtimer Timing + 29.1.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing the markets

successfully for over 25 years.

Join us and start

winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Regularly

Followed Weekly Charts

NYSE Advance-Decline

Line

Market breadth closed lower still

this week after losing ground in the

previous week. This after new highs

and a rally lasting five weeks.

Good breadth is the number one indicator

of a healthy stock market.

MACD has turned lower and had a bearish

crossover in mid-June.

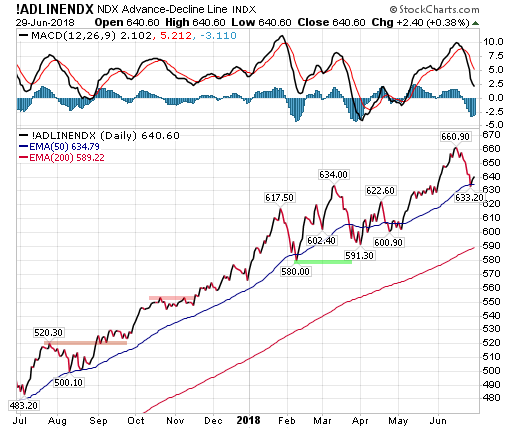

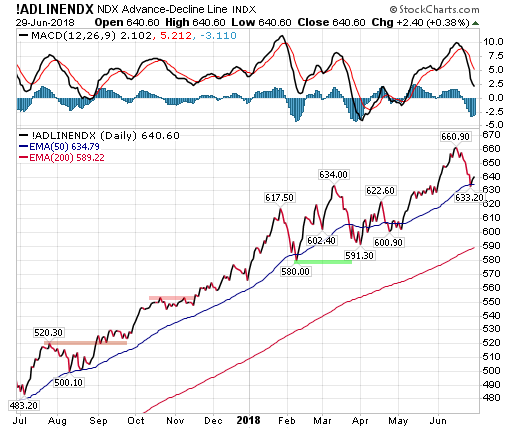

The Nasdaq 100 Index Advance-Decline Line continued the previous week's decline

and only stopped moving lower during Thursday's advance.

On Thursday the NDX A-D line reversed

off its 50-day moving average line

which is a positive.

But as we wrote last week, one week

of declines is not a concern but this

is now the second week of losses.

The 50-day needs to hold. If not we

have substantially lower lows ahead.

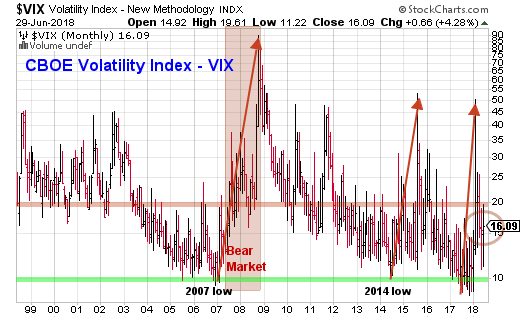

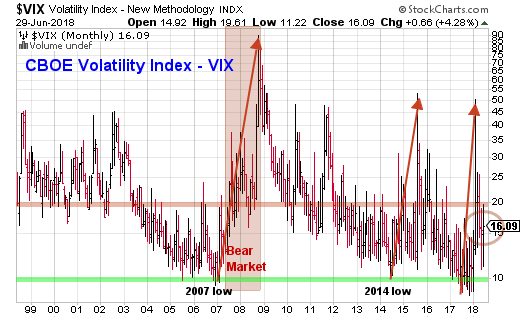

CBOE Volatility

Index (VIX).

The CBOE Volatility Index (VIX) reached

19.61 during the week. It closed at

16.09 but VIX was down at 11.22 during

this month.

Extreme bullishness is contrarian

bearish (eventually).

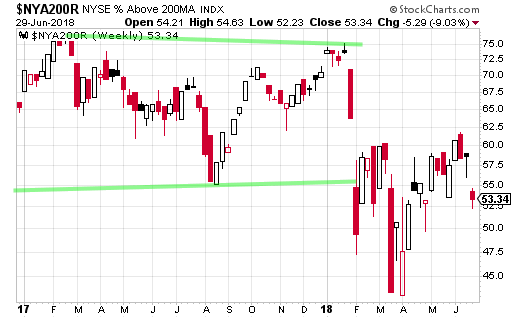

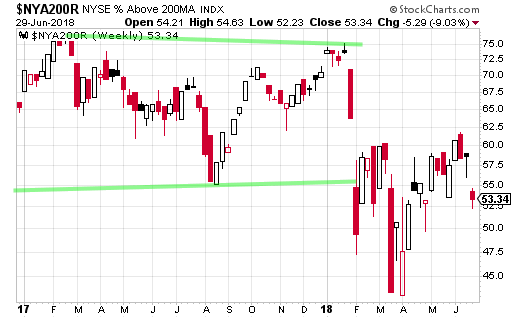

Market Internals

The number of stocks

trading above their 200-day average

declined -9.0% this week.

By the close on Friday

53.34% of stocks were trading above

their 200-day average line.

This was down from 58.64%

the previous week.

Sentiment Indicators

These are contrarian

indicators. Typically, when advisors

are mostly bullish, the markets are

near a top.

Note that these numbers

are from a week ago. They reflect

the preceding week's sentiment.

The

number of bulls remains high. Remember

that those who are neither bullish

nor bearish have bullish positions

and really should be considered bullish.

Add bulls and those not specifically

bearish and you get 81.6%

with at least some bullish market positions.

Fibonacci Support

/ Resistance Levels

We are now looking at "support

levels" from the correction lows.

Fib support levels on the weekly chart

are as follows; the 38.2% retracement

support at 2470, the 50% retracement

support at 2346 and the critical 61.8%

retracement support at 2222.

Market Moving

Economic Reports Released this Week:

Sales of newly-constructed homes were

6.7% higher than a downwardly-revised

April pace, and 14.1% higher than a

year ago, the Commerce Department said

Monday. New-home sales ran at a seasonally

adjusted annual 689,000 rate in May.

Americans are still very optimistic

about the U.S. economy, but a little

less so than they were a month ago.

The consumer confidence index slid

to 126.4 this month from a revised

128.8 in May, according to the nonprofit

Conference Board that publishes the

report. Economists surveyed by MarketWatch

had forecast a 128.0 reading

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 291.4 % |

3

Year Results

Fibtimer Timing + 67.8 %

|

1

Year Results

Fibtimer Timing + 29.1.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Home prices slowed going into and

during the early part of the Spring

selling season with Case-Shiller the

latest to confirm the softening. Case-Shiller's

20-city adjusted index managed only

a 0.2 percent gain in April to come

up short of Econoday's low estimate.

The year-on-year rate, at 6.6 percent,

is no better than the low estimate.

Disruption tied to a fire at an auto

supplier not only pulled down the previously

released manufacturing component of

the industrial production report but

it also helped pull down durable goods

orders in May which fell an as-expected

0.6 percent. Vehicle orders fell 4.2

percent in the month with vehicle shipments

down 4.4 percent

Retail inventories, trying to keep

pace with rising strength in retail

sales, rose 0.4 percent in May following

a 0.5 percent build in April, both

of which are positives for second-quarter

GDP.

U.S. pending home sales declined 0.5%

to a reading of 105.9 in May, the National

Association of Realtors said Wednesday.

NAR’s index, which tracks real-estate

transactions in which a contract has

been signed but the transaction hasn’t

yet closed, hit a four-month low in

May.

Inflation was a little bit warmer

than thought in the first quarter,

a factor that deflates the third estimate

of first-quarter GDP more than expected

which came in at a 2.0 percent annualized

rate to just make the low end of Econoday's

consensus range. The GDP price index

came in at 2.2 percent.

Initial jobless claims rose more than

expected in the June 23 week but remain

very low, at 227,000 which lifts the

4-week average only marginally to 222,000.

This average is roughly in line with

readings in May which points convincingly

at another strong employment report

for the month of June. Continuing claims,

where data lag by a week, fell 21,000

to 1.705 million with this 4-week average

down 3,000 to 1.720 million.

Consumers were upbeat about June but

turned less optimistic on the outlook.

These were the results of Tuesday's

report on consumer confidence and today's

consumer sentiment report. June's current

conditions component rose a sharp 5.7

points to 116.5 which hints at bounce-back

strength for the month's consumer spending,

but the expectations component, subdued

by tariff concern, fell 2.8 points

to 86.3 which is lowest reading since

mid-January.

Conclusion:

There was continued downside this

week but of more concern were the two

bearish reversal days. The first on

Wednesday was a bearish outside reversal

day and then on Friday a rally almost

completely disappeared by the close.

Breadth declined for the second week

in a row. The July 4th week is typically

a bullish one. Maybe we will see gains.

If not though we could be in for a

rough July.

The SPX portion of this

strategy is BEARISH. Aggressive traders

should be in CASH (money market funds).

S&P 500 Index (SPX) Daily Chart

S&P 500 Index (SPX), Weekly Chart

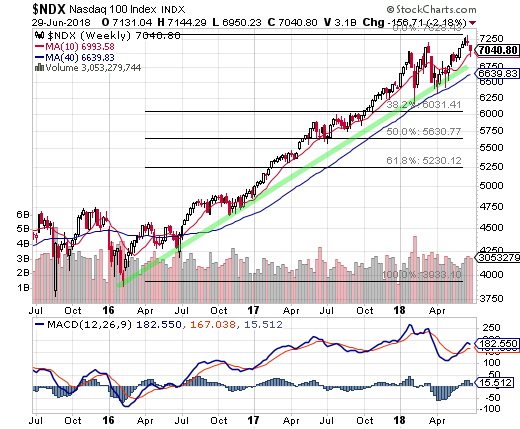

Nasdaq 100 Index (NDX) Chart Analysis

Last week we wrote:

"Technology stocks finally

pulled back this week after almost continuous

gains for the sector since early May. For the

full week the Nasdaq 100 Index (NDX) dropped

-0.80%."

This week:

Tech stocks took a big tumble on Monday of this

week and it did not get any better during the

rest of the week. For the full week the Nasdaq

100 Index (NDX) dropped -2.18%.

On Wednesday the NDX suffered a bearish outside

reversal day. Typically there will be lower lows

after such a reversal day.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports are

great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 291.4 % |

3

Year Results

Fibtimer Timing + 67.8 %

|

1

Year Results

Fibtimer Timing + 29.1.%

|

Sleepless

nights as your investments are consumed

by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend, which

ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

The lows on Wednesday broke below the initial

support level at NDX 7000. The NDX dropped to its

rising 50-day average early on Thursday before

closing with a gain.

But similar to the SPX, a rally on Friday was

mostly erased by the close to end the week lower.

MACD on the daily chart has made a bearish crossover.

On the weekly chart MACD remains in bullish territory

and has posted a bullish crossover.

We have posted Fibonacci retracement "support" levels

for the advance from the February 2016 lows. Those

Fib support levels (weekly chart) are; 38.2% at

NDX 6031, 50% at NDX 5630 and 61.8% at NDX 5230.

Conclusion:

A second week of declines and those declines have

escalated.

A big concern is the NDX Advance-Decline line

which dropped for a second week.

The NDX portion of this strategy

is BEARISH. Aggressive traders should be in CASH

(money market funds).

Nasdaq 100 Index (NDX), Daily Chart

Nasdaq 100 Index (NDX), Weekly Chart

|