|

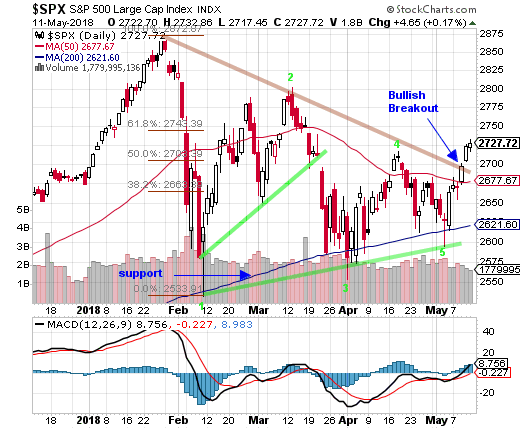

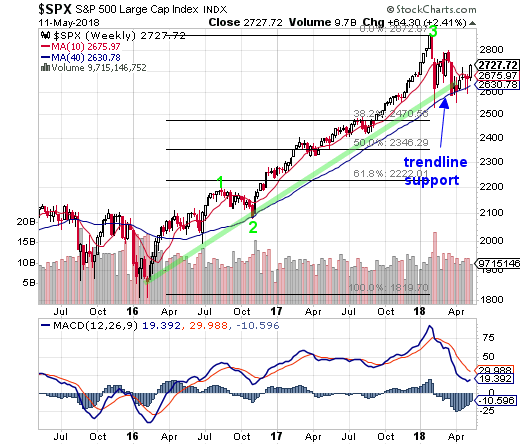

S&P

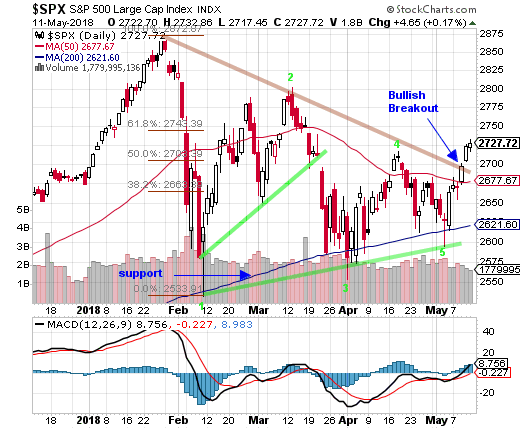

500 Index (SPX) Chart Analysis

Last week:

"After successfully

testing its 200-day moving average line

on Thursday, the S&P 500 Index (SPX)

opened at that line on Friday and then

posted a reversal rally that will likely

trigger a buy signal in coming days.

The reversal did trigger a buy in the

Nasdaq 100 Index (NDX) portion of this

strategy which will result in a 50%

invested position for the strategy at

the close on Monday."

This week:

Last week we had a breakout for the Nasdaq

100 Index (NDX). This week the S&P

500 Index (SPX) also broke out as well

as most of the major indexes.

There are several very bullish indicators

pointing to this rally being the one that

finally puts the correction to rest.

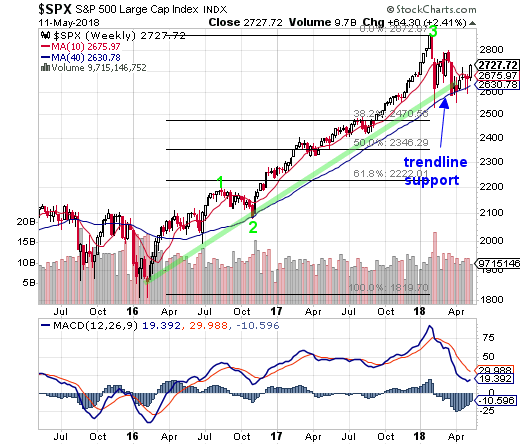

First, the below chart shows a pennant

pattern. Breakouts or breakdowns from

pennant patterns typically point to the

direction the stock market will now take.

On Wednesday the SPX closed above its

long-term declining trend resistance line

(top line of the pennant.) This was followed

by an upside gap opening the following

day.

Second, pennant patterns tend to have

a five wave pattern. Last week's lows

were the wave five of a clearly marked

Elliott Wave pattern. Wave five was followed

by the breakout.

Third, this was the third test of the

200-day moving average line as well as

the rising trend support line (lower line

of the pennant.) This correction has lasted

much longer than typical. The market was

due a reversal and rally that potentially

will again reach the prior highs.

The third test of major support, if successful,

tends to be the final one.

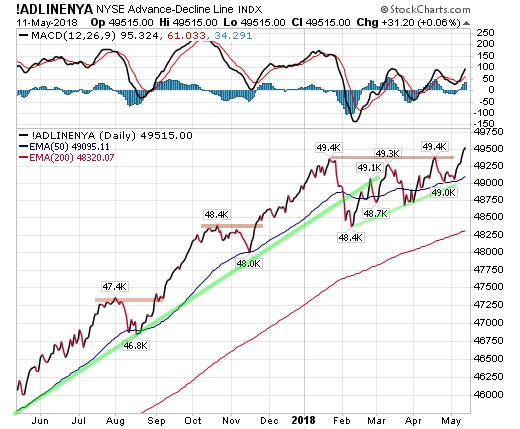

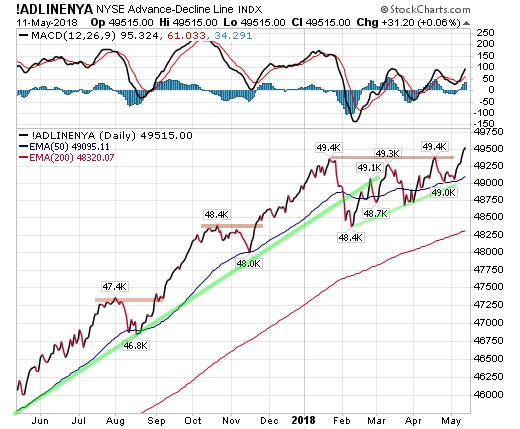

Another huge positive is the NYSE Advance-Decline

Line which broke out to a new bull market

high.

This means it was not just a few powerful

companies pulling the market up, but most

of the companies in the NYSE which has

1600 stocks.

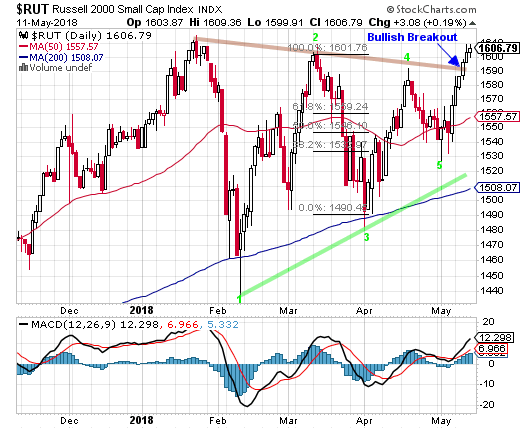

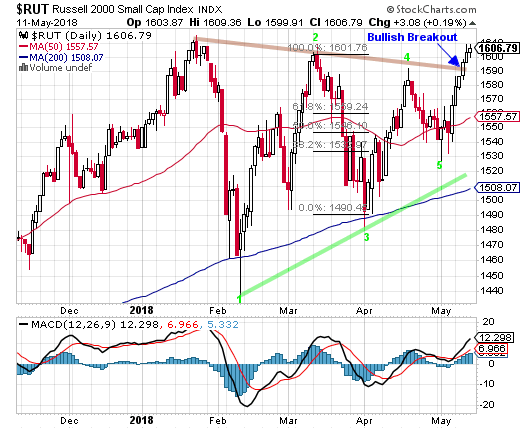

Lastly small caps almost closed at a

new bull market high. Small caps have

been strong for weeks now and this week

they tested their 50-day line which held.

Not the 200-day line like the other indexes,

but the 50-day. The test of the 50-day

also completed a five-wave pattern.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports

are great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your investments are

consumed by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend,

which ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Small caps broke above their declining

trend resistance line and closed just

a fraction from new highs.

One last item. MACD managed to close

in bullish territory.

Regularly

Followed Weekly Charts

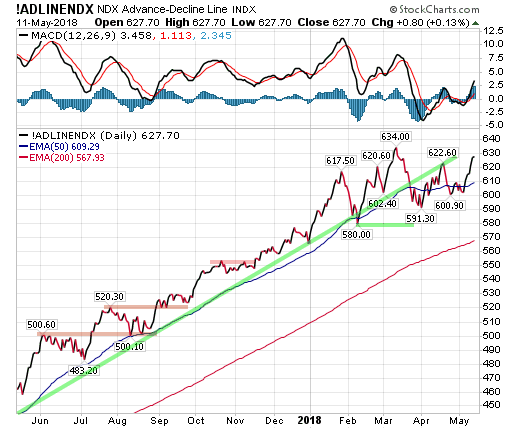

NYSE Advance-Decline

Line

Market breadth has broken out to a new

high. Not just a fractional new high

but a solid breakout.

Interestingly the A-D line also formed

a five-wave pattern and each down wave

ended with a higher low. Each up wave

has had a higher high.

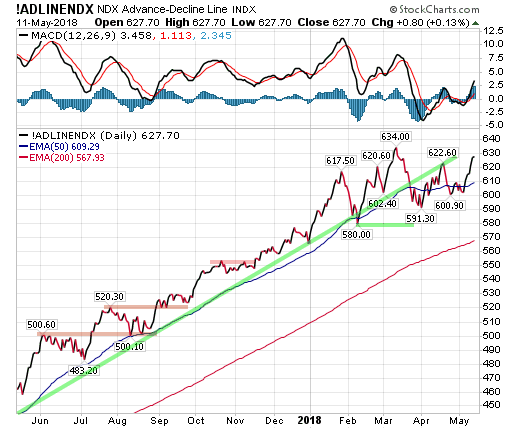

The Nasdaq 100 Index Advance-Decline

Line closed this week well above its

50-day average.

The NDX A-D line appears to be following

its 50-day average with weekly closes

both above and below it.

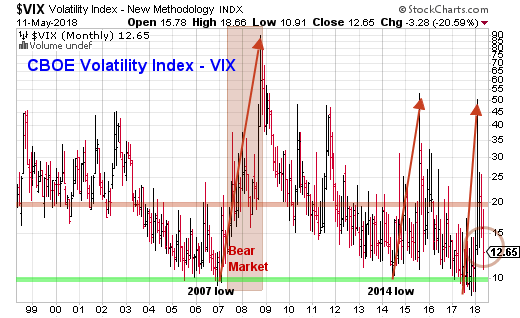

CBOE Volatility

Index (VIX).

The CBOE Volatility Index (VIX) had

a substantial decline this week, closing

at 12.65.

This tells us that investors are turning

bullish. They do not feel the need to

cover their positions with insurance

in the form of options.

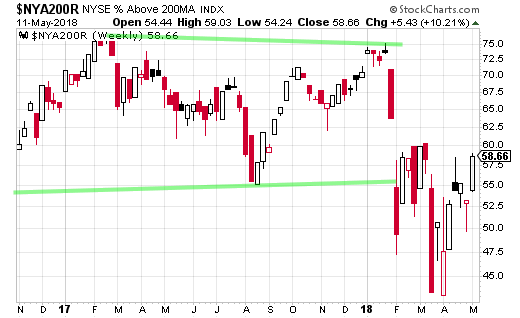

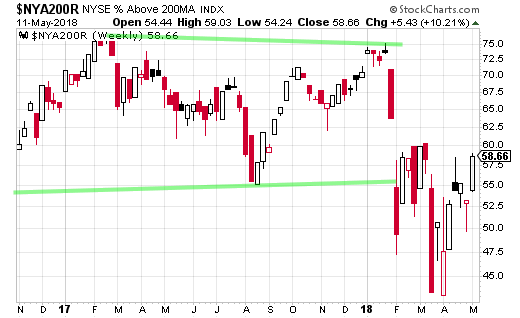

Market Internals

The NYSE percent of stocks

that are trading above their 200-day

averages jumped this week and has now

erased half of its correction losses.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing the markets

successfully for over 25 years.

Join us and start

winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

By the close on Friday

58.66% of stocks were trading above

that line as compared to 53.22% the

prior week.

Sentiment Indicators

These are contrarian

indicators. Typically, when advisors

are mostly bullish, the markets are

near a top.

Note that these numbers

are from a week ago. They reflect

the preceding week's sentiment.

The

number of bulls remains high. Remember

that those who are neither bullish

nor bearish have bullish positions

and really should be considered bullish.

Add bulls and those not specifically

bearish and you get 79.4%

with at least some bullish market positions.

Fibonacci Support

/ Resistance Levels

We are now looking at "support

levels" from the correction lows.

Fib support levels on the weekly chart

are as follows; the 38.2% retracement

support at 2470, the 50% retracement

support at 2346 and the critical 61.8%

retracement support at 2222.

Market Moving

Economic Reports Released this Week:

A stronger increase in consumer credit

is the call for March, at a consensus

$15.6 billion vs $10.6 billion in February.

Growth in revolving credit has slowed

sharply this year and is one of the

factors that has held down consumer

spending.

The highest earnings improvement levels

in 45 years helped support small business

optimism in April after a sharp decline

in the previous month, according to

the National Federation of Independent

Business (NFIB), whose monthly Small

Business Optimism Index ticked up by

0.1 point in April to 104.8, roughly

in line with the consensus forecast.

The number of job openings in the

U.S. surged in March to a record 6.55

million from 6.1 million, showing companies

are still eager to add workers with

the economy growing soundly almost

nine years after the last recession.

There are more than enough job openings,

at 6.550 million in March, to give

everyone who's looking for a job, at

6.346 million in April's employment

report, a job. And though 5.425 million

were hired in March, the gap between

openings and hires in today's JOLTS

report, at 1.125 million, is the largest

on record which suggests that employers

are having a hard time finding people

with the right skills.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Purchase applications for home mortgages

fell a seasonally adjusted 0.2 percent

in the May 4 week, shrinking the unadjusted

year-on-year gain to 3 percent. Applications

for refinancing fell 1 percent from

the previous week to their lowest level

since October 2008, with the refinance

share of mortgage activity decreasing

by 0.2 percentage points to 36.3 percent,

the smallest share since September

2008.

Usually there's not much difference

between the advance inventory estimate

and the month's final, but there is

in March. Wholesale inventories rose

only 0.3 percent vs the advance gain

of 0.5 percent. The build however is

in line with sales which also rose

0.3 percent in the month to keep the

stock-to-sales ratio unchanged at 1.26.

Prices are up for steel and aluminum

but overall wholesale prices proved

subdued in April. The headline increase

of only 0.1 percent is 2 tenths below

Econoday's consensus and 1 tenth below

the low estimate. When excluding food,

where prices fell 1.1 percent, and

also energy, which inched only 0.1

percent higher, producer prices did

manage an as-expected 0.2 percent increase.

When excluding food and energy and

also a 0.2 percent gain for trade services,

the result is only plus 0.1 percent

which, like the headline, is below

the low estimate.

The number of people who applied for

U.S. unemployment benefits in early

May stood at 211,000 for the second

straight week, keeping initial jobless

claims near a 49-year low. New claims

were flat at 211,000 in the seven days

ended May 5, the government said Thursday.

The consumer price index rose 0.2%

in April, the government said Thursday.

A more closely followed measure that

strips out food and energy, known as

the core CPI, rose a smaller 0.1% last

month.

The consumer sentiment index held

steady at a solid 98.8 for preliminary

May led by a modest gain in the expectations

component, now at 89.5, which offset

a slight dip in the assessment of current

conditions, at 113.3. Year-ahead inflation

expectations edged 1 tenth higher to

2.8 percent, a level last matched back

in March this year but not surpassed

since March 2015.

Conclusion:

On Friday of last week the stock market

reversed higher from its 200-day moving

average line and this week that reversal

was confirmed with a strong rally that

broke through several important resistance

levels.

Last week's reversal also confirmed

this to be a five-wave decline which

is what was expected in a pennant pattern.

The SPX portion of this

strategy is BULLISH. Aggressive traders

should be in the Rydex Nova S&P

500 Fund - RYNVX (or other bullish

S&P 500 index fund or ETF such

as SPY or RSP).

S&P 500 Index (SPX) Daily Chart

S&P 500 Index (SPX), Weekly Chart

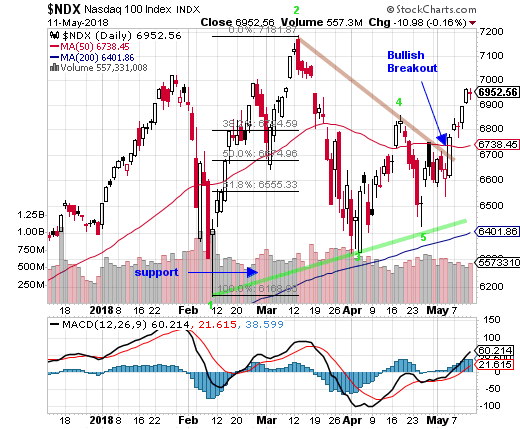

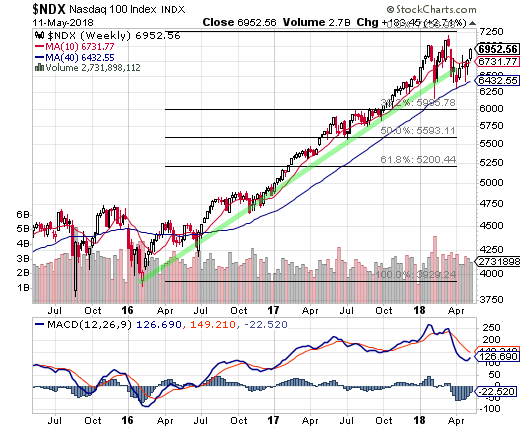

Nasdaq 100 Index (NDX) Chart Analysis

Last week we wrote:

"The Nasdaq 100 Index

(NDX) rallied on Friday and the advance pushed

this tech dominated index to its highest close

in three weeks. That close was also above its

50-day moving average line though it was not

above the highest April close reached mid-month."

This week:

Last week's Friday breakout

for the Nasdaq 100 Index (NDX) pushed the index

above its declining trend resistance line as

well as its 50-day moving average line.

The decline last week ended

just a fraction above the rising trend support

line and made this a five-wave corrective pattern

which is what we should see in a pennant pattern.

Most investors are shell-shocked from the volatility

and unexpected reversals and declines in this

correction. While nothing can be guaranteed,

this advance has the technical underpinnings

of a rally that will test and hopefully surpass

the prior highs.

The big news is the close above the declining

trend resistance line which had remained unbroken

since mid-march.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports are

great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your investments are consumed

by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend, which

ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

MACD on the daily chart remained bullish during

the week and closed at 60.21.

On the weekly chart MACD remains

in bullish territory and though it is still in

a bearish crossover, weekly MACD has reversed higher..

We have posted Fibonacci retracement "support" levels

for the advance from the February 2016 lows. Those

Fib support levels (weekly chart)

are; 38.2% at NDX 5995, 50% at NDX 5593 and 61.8%

at NDX 5200.

Conclusion:

Last week's Friday rally triggered a buy signal

for the NDX and the tech index posted a solid +2.71%

gain this week.

The NDX portion of this strategy

is BULLISH. Aggressive traders should be in the

Rydex NDX 100 Fund - RYOCX (or other bullish NDX

100 index fund or ETF such as QQQ).

Nasdaq 100 Index (NDX), Daily Chart

Nasdaq 100 Index (NDX), Weekly Chart

|