|

These free reports, twice a month, are

useful, but to successfully trade market

trends you need our daily reports. At

half price they are an affordable and

valuable tool for creating profits in

the stock market.

Special

HALF PRICE Offer ---> CLICK

HERE NOW

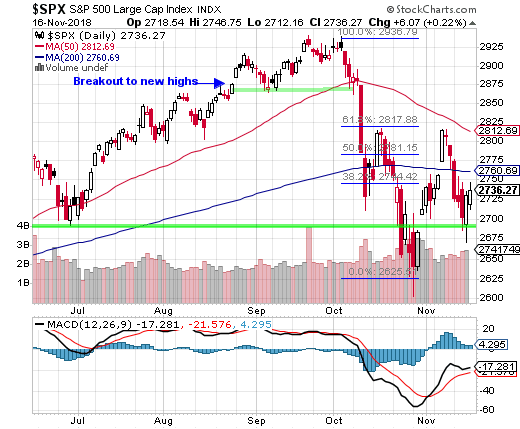

S&P

500 Index (SPX) Chart Analysis

Last week:

"Technically speaking,

the major indexes have staged an impressive

rally from the correction lows, with

single-day rallies exceeding 2%. The

S&P 500 has pushed above its 200-day

moving average, testing that average

on Friday and continuing to hold above

it."

This week:

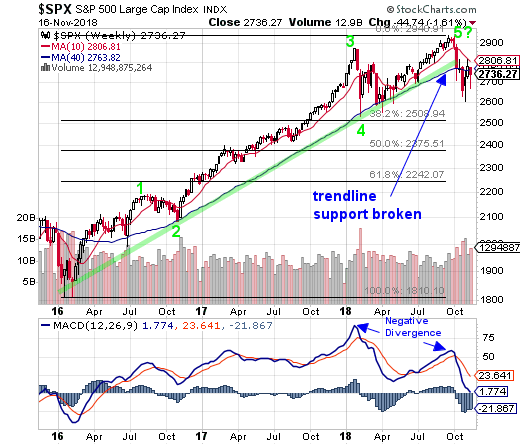

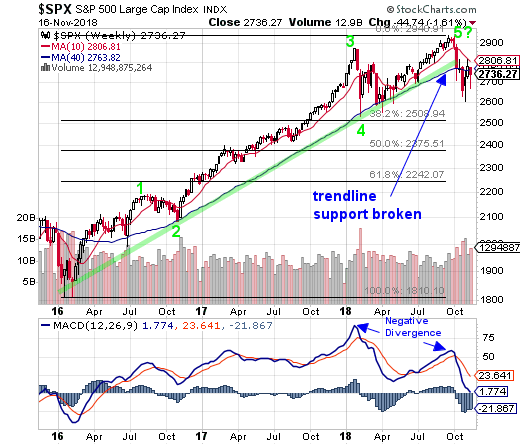

On the weekly chart of the S&P 500

Index (SPX) there is a bearish divergence

in the latest SPX highs and MACD which

did not make new highs.

The below weekly chart shows the new

high in the end of September but a failure

to make a new high in MACD.

This was a warning of weakness to come.

Add this bearish divergence to the previously

discussed potential of an Elliott Wave

top.

The above weekly chart of the SPX has

been labelled with this wave series for

months.

Basically we could be starting a correction

that would be expected after a five wave

Elliott Wave pattern is completed.

This has been a two year pattern and

it certainly looks like wave 5 may well

have been completed. A decline after such

a five wave pattern could be expected

to erase up to 61.8% of the gains.

That is a worst case scenario and it

might not even happen. But the potential

for substantial declines is something

to be watching for.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports

are great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your investments are

consumed by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend,

which ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

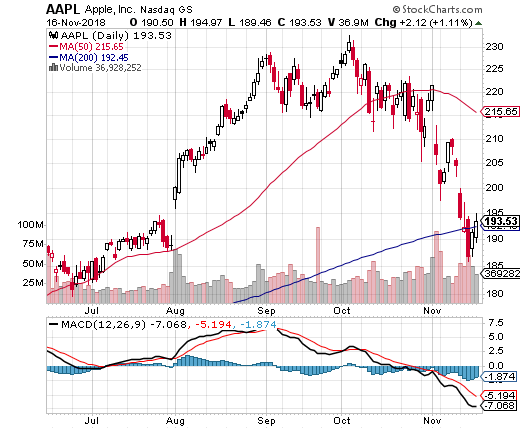

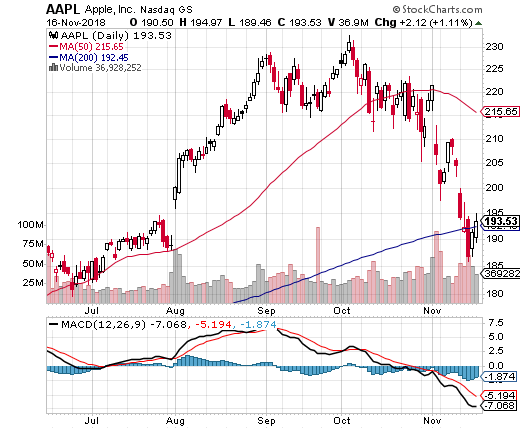

Although it rebounded from Wednesday's

low, the premier stock in the stock market

Apple, Inc. (AAPL) officially entered

a bear market that day on heavy volume.

That is bad news for the bull market

as a whole and by itself has caused selling

in technology stocks.

Apple lost -5.04% on Wednesday alone.

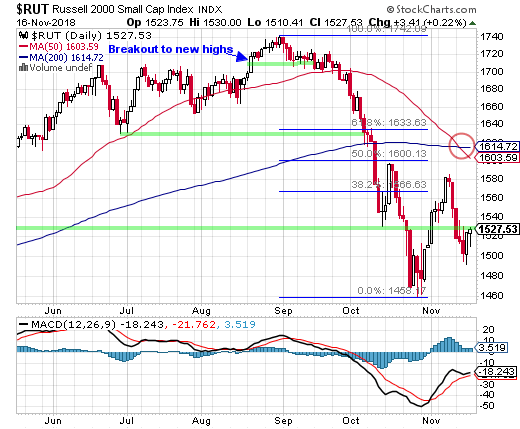

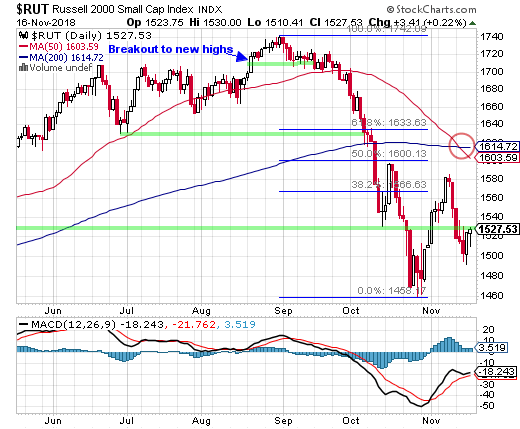

Some call it a "death cross" and

the name alone tells you how it is perceived

when the 50-day moving average line of

the small-cap Russell 2000 Index (RUT)

closed beneath its long-term 200-day

moving average.

Many chart watchers believe this is

the point that a short-term decline changes

into a longer-term downtrend.

This is the first time that the 50-day

crossed below its 200-day since May,

2016.

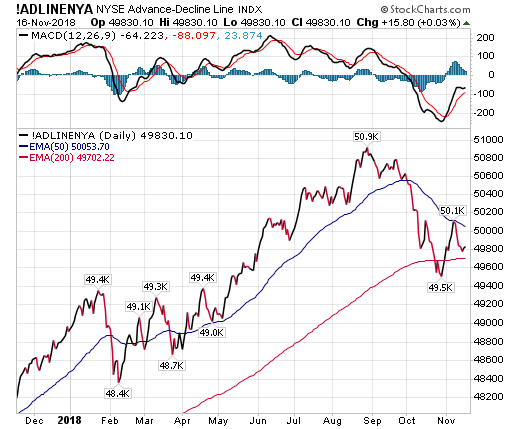

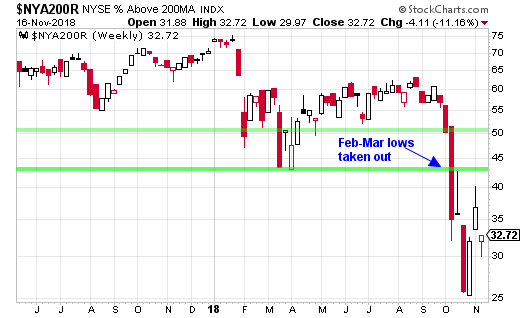

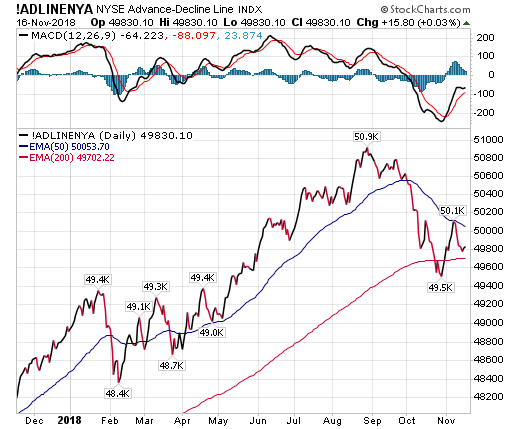

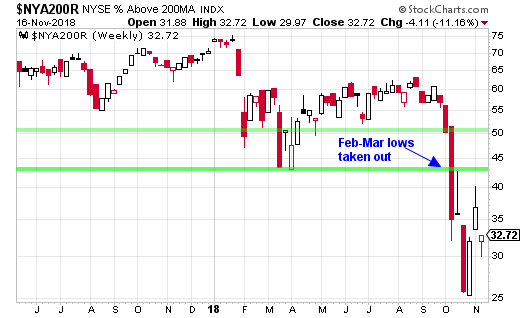

Lastly we look at the breadth charts

which are disturbing.

After a brief rally to the 50-day average,

the NYSE Advance-Decline Line fell back

to its 200-day average and the last two

days of this week, when prices improved,

are hardly a blip to the upside.

The number of stocks in the NYSE trading

above their 200-day line remains near

its lows.

Fully 67.3% of stocks in the NYSE Composite

Index of 1600 stocks remain below their

200-day averages.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing the markets

successfully for over 25 years.

Join us and start

winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Regularly

Followed Weekly Charts

NYSE Advance-Decline

Line

The NYSE A-D Line moved up to its

50-day and then reversed lower.

MACD has posted a bullish crossover

but remains in bearish territory for

the first time since March.

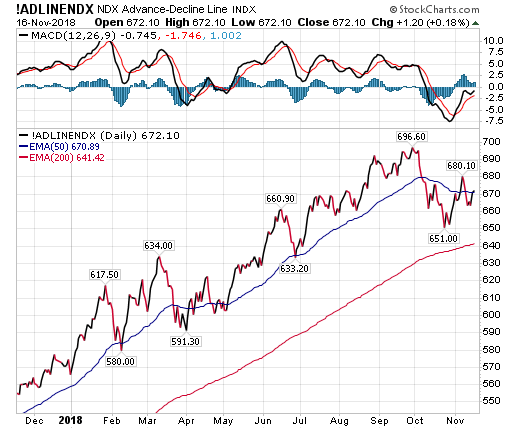

The Nasdaq 100 Index Advance-Decline Line never dropped to its 200-day average

and this week managed to regain its 50-day average and close fractionally

above.

The break above the 50-day line is

good, but the overall chart does not

look good.

MACD continues to rise and is nearing

bullish territory.

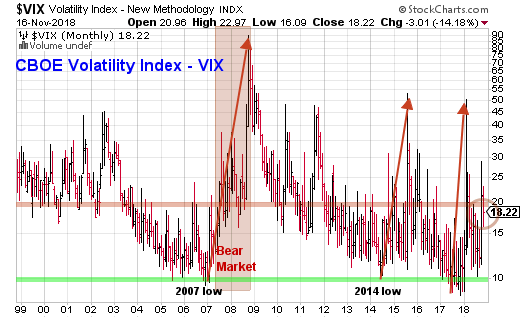

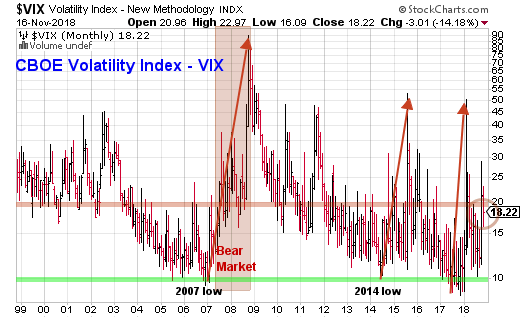

CBOE Volatility

Index (VIX)

The CBOE Volatility Index (VIX) closed

this week at 18.22.

This level does not give us any hint

at where stocks will go next week.

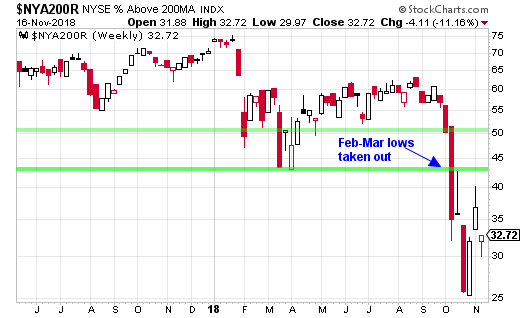

Market Internals

The number of stocks trading above

their 200-day average continues to

be a concern. Though you can see two

weeks of strong gains, still the number

of stocks below their 200-day line

is very high.

The losses substantially exceed the

February-March selloff which is a worry.

32.72% above their 200-day

average lines is a very low number.

Consider that fully 67.3%

of the 1600 stocks on the NYSE remain "below" their

200-day line.

Sentiment Indicator

This is a contrarian

indicator. Typically, when advisors

are mostly bullish, the markets are

often near a top.

Note that these numbers

are from a week ago. They reflect

the preceding week's sentiment.

The

number of bulls remains high. Remember

that those who are neither bullish

nor bearish have bullish positions

and really should be considered bullish.

Add bulls and those not specifically

bearish and you get 81.0%

with at least some bullish market positions.

Fibonacci Support

/ Resistance Levels

We are now looking at "support

levels" from the correction lows.

Fib support levels on the weekly chart

are as follows; the 38.2% retracement

support at 2508, the 50% retracement

support at 2375 and the critical 61.8%

retracement support at 2242.

Market Moving

Economic Reports Released this Week:

The National Federation of Independent

Business small-business optimism index

declined 0.5 point to a seasonally

adjusted 107.4 in October, a four-month

low. The biggest declines of the 10

components that make up the index came

from questions on expansion and earnings

trends, while the only gain came from

plans to increase inventories.

Same store sales were up 6.1 percent

year-on-year in the November 10 week,

unchanged from the prior week and maintaining

the strongest annual growth pace since

the 6.5 percent decade highs seen at

the start of October. Month-to-date

sales versus the prior month were up

0.2 percent, an acceleration of 0.1

percentage points from the prior week,

while the full month year-on-year gain

rose to 6.1 percent, the fastest pace

in 9 weeks.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Rising interest rates continue to

dampen mortgage activity, with purchase

applications for home mortgages falling

a seasonally adjusted 2.3 percent in

the November 9 week to the lowest level

since February 2017 while refinancing

applications decreased by 4.3 percent

to the lowest level since December

2000.

Energy prices which are now sliding

lifted what is yet another subdued

consumer inflation report, this time

for October where the headline, at

a moderate and as-expected 0.3 percent

increase, overstates the pressure.

Energy jumped 2.4 percent in October

led by a 3.0 percent rise in gasoline

prices which appear certain to come

down in the November report given the

ongoing tumble in the price of oil.

The core rate, which excludes energy

and also food, came in as expected

at 0.2 percent.

Initial jobless claims are steady

at low and favorable levels, edging

only 2,000 higher in the November 10

week to 216,000 with the 4-week average

up only 1,500 to a 215,250 level that

is only slightly higher than mid-October.

The first hard indication on what

to expect for fourth-quarter consumer

spending is positive but not as enormously

positive as October's 0.8 percent headline

surge in retail sales would suggest.

Control group sales, which importantly

are inputs into personal consumption

expenditures and which exclude categories

that were especially strong in October,

rose a more moderate 0.3 percent with

September for this reading revised

2 tenths lower to also a 0.3 percent

gain.

Last week's producer price report

showed unexpected pressure in October

as does today's report on import prices

and export prices, up 0.5 percent and

0.4 percent respectively which both

top Econoday's high estimates.

Industrial production edged up 0.1%

in October, the Federal Reserve said

Friday, but there was a big upward

revision that moved third-quarter numbers

significantly higher. Capacity utilization

fell to 78.4% from 78.5% in September.

Conclusion:

The SPX is back in cash and has again

closed below its 200-day average line

at the close on Friday. For the full

week the SPX lost -1.61%.

The weakness in the breadth charts

is likely pointing to more selling

ahead, though there could be huge volatility

on a daily basis in both directions.

The potential that we have finished

a two-year bullish 5-wave Elliott Wave

pattern (weekly chart below). If this

is correct, the decline that follows

truly could be substantial.

The SPX portion of this

strategy is BEARISH. Aggressive traders

should be in CASH (money market funds).

S&P 500 Index (SPX) Daily Chart

S&P 500 Index (SPX), Weekly Chart

Nasdaq 100 Index (NDX) Chart Analysis

Last week we wrote:

"Although the Nasdaq 100

Index (NDX) managed to push above its 200-day

moving average this week, it did not hold.

By the close on Friday the NDX was off -1.67%

in one day closing at 7039.15."

This week:

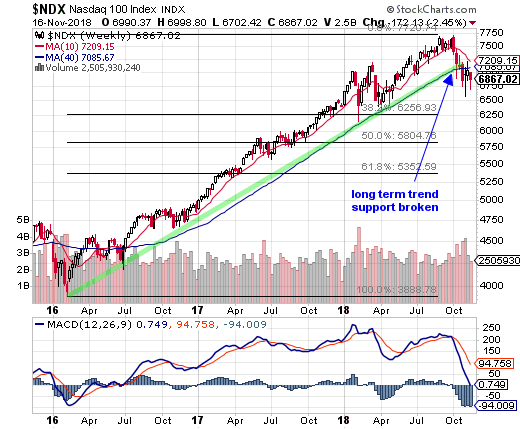

The Nasdaq 100 Index (NDX) had only a single

day of gains this week and the tech index lost

a whopping -2.45% for the full week.

Again the NDX finds itself well below its 200-day

moving average line.

Breadth indicators improved last week for the

NDX with the A-D line trading above its 50-day

average for a short time, but this week the A-D

line closed decidedly lower and the rally on

Thursday resulted in only a small fractional

gain to the upside.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports are

great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 287.0 % |

3

Year Results

Fibtimer Timing + 67.2 %

|

Sleepless

nights as your investments are consumed

by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend, which

ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

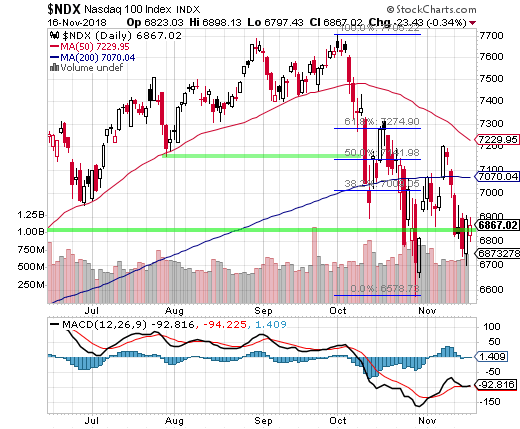

MACD on the volatile daily chart is now deep in

bearish territory and trading sideways.

On the weekly chart MACD has had a steep bearish

crossover and is close to entering bearish territory.

We have posted Fibonacci retracement "support" levels

for the advance from the February 2016 lows. Those

Fib support levels (weekly chart) are; 38.2% at

NDX 6256, 50% at NDX 5804 and 61.8% at NDX 5352.

Conclusion:

We have what looks like a bearish double-top in

the NDX on the daily chart.

Last week the 200-day line was broken to the downside.

This week, with four down days, the NDX is again

far below this 200-day average line.

The NDX portion of this strategy is BEARISH. Aggressive

traders should be in CASH (money market funds).

Nasdaq 100 Index (NDX), Daily Chart

Nasdaq 100 Index (NDX), Weekly Chart

|