|

S&P

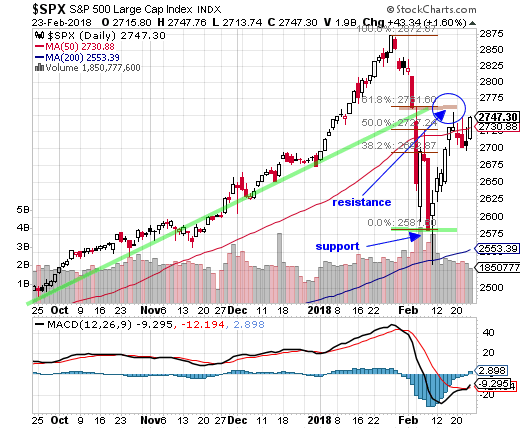

500 Index (SPX) Chart Analysis

Last week:

"Has everyone forgotten

last week? Selling that fast and steep

does not just end with a rally to new

highs. Try and remember the two days

that declined some 4% each. Those are

huge single day losses. They damage

the technical underpinnings of the stock

market."

This week:

Volatility still rules the

day. Big swings in price are the norm,

at least for now.

On Wednesday the Dow was up 303 points,

yet the big gain disappeared near the

end of the trading day, with the Dow losing

167 points at the close. That is a 470

point swing or about 1.9%.

It was also a bearish reversal

day in the S&P 500 Index (SPX). Bearish

reversal days occur when the index surges

to higher highs than the previous trading

day and then ends at lower lows than the

previous trading day.

They are bearish indicators

typically followed by several weeks of

lower lows. So far that has not been the

case.

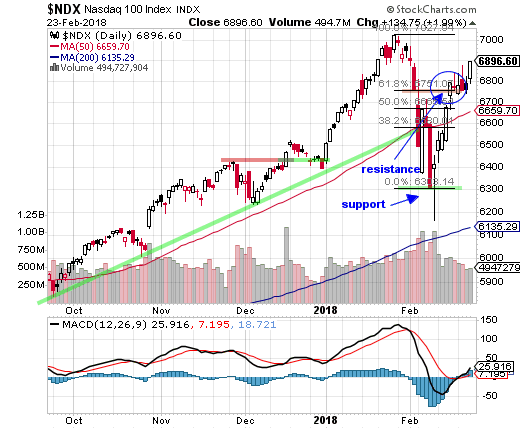

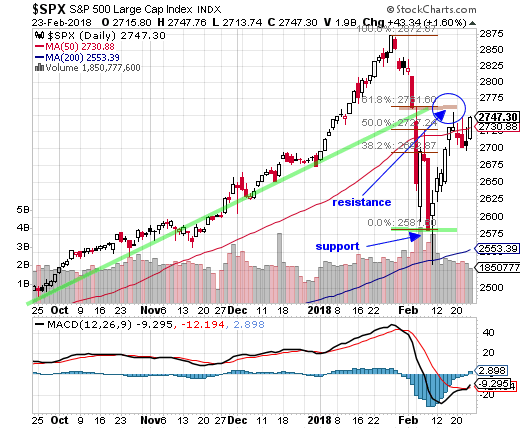

On Friday the major indexes

rose in a broad advance. But while the

Nasdaq 100 Index (NDX) has broken above

resistance, the SPX and the Russell 2000

Small Cap Index (RUT) both remain just

below resistance.

That puts the NDX at a bullish

level and will force an entry (see below).

It also leaves the SPX and RUT still below

the resistance level. These levels are

capable of stopping an advance. So they

are important for any bullish entries.

In the below chart of the

SPX you can see how the Fib 61.8% level

is acting as resistance. It was almost

reached last week and then the SPX sold

off all week with the exception of Friday.

Still, Friday's advance did not break

through the resistance level.

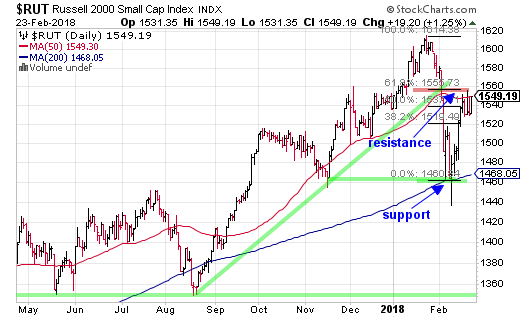

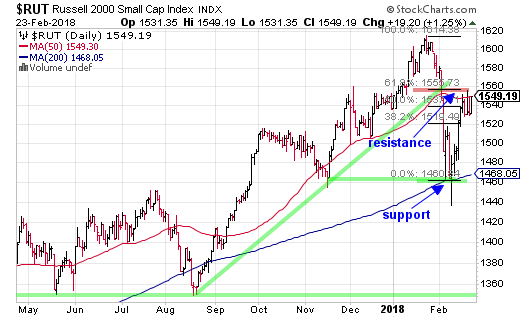

Below is the daily chart of the Russell

2000 Small Cap Index (RUT). We typically

look at this chart because it is moved

mostly by individual traders. The big

institutional traders use stocks in the

NYSE and SPX.

Support is at about the 200-day moving

average line. Resistance is at about RUT

1555 which is the Fib 61.8% resistance

level

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports

are great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your investments are

consumed by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend,

which ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Small caps also were unable to break

through the 61.8% resistance level. This

level is also right at the 50-day moving

average line. Strong resistance.

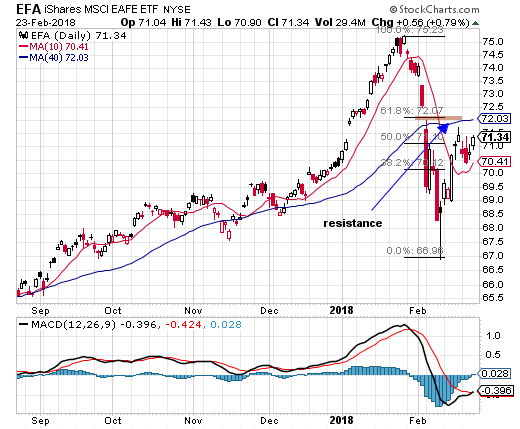

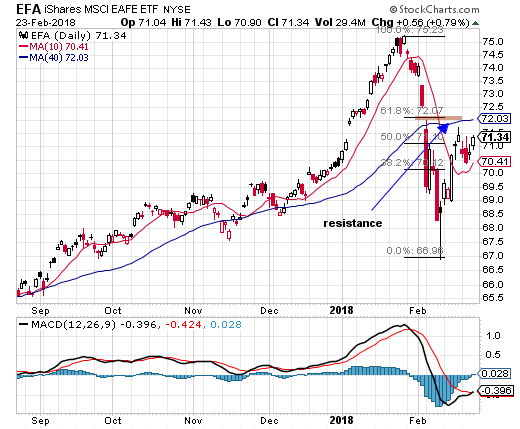

There are other major indexes

having the same problem. For example

overseas markets as represented by the

International markets iShares MSCI Index

Fund (EFA) are having difficulty pushing

through resistance at the Fib 61.8% level.

There are several major indexes unable, so far, to break through critical resistance.

Then there is the NDX which

pushed through with no difficulty. That

position (below) is being forced by our

strategy to enter a bullish position.

Interestingly, Federal Reserve policymakers

see an economy that may be past full

employment. That statement was a surprise.

Past full employment!

These conditions will continue to call

for more rate increases in 2018.

Fed watchers widely expect the FOMC

to approve a quarter-point rate hike

in March and likely two more through

the rest of 2018. Now there is talk of

a fourth hike.

Last week we wrote: "Of course

if it is (different this time) we will

have to adjust and start reentering.

But we are, at this point, looking

for a pull back and eventually a test

of the lows."

Apparently it is different for the NDX

and, so far, not for the other major

indexes.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing the markets

successfully for over 25 years.

Join us and start

winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

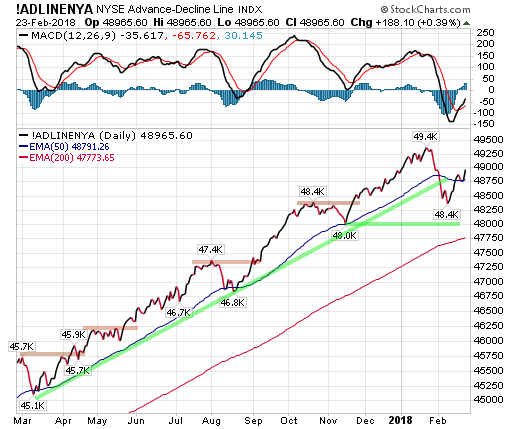

Regularly

Followed Weekly Charts

NYSE Advance-Decline

Line

The NYSE Advance-Decline line climbed

higher this week as Friday's advance

added to the gain. So far the A-D line

has made up about half of the losses.

We have support at about the 48000

level on the below chart.

Suprisinglyy, the A-D line is back

above its 50-day line.

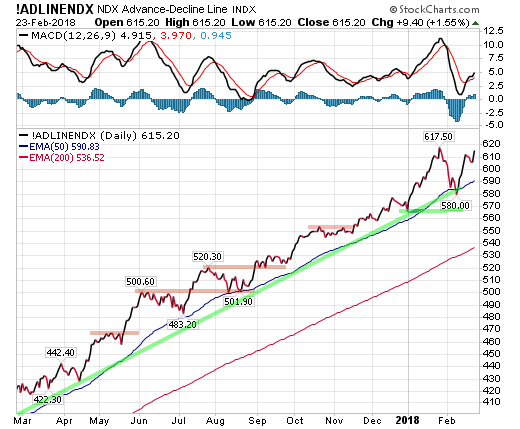

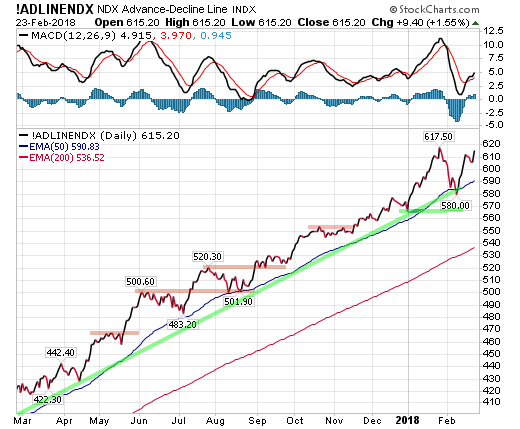

The Nasdaq 100 Index Advance-Decline

Line decline hit its rising trend support

line last week. That line is also at

the same level as its 50-day moving

average.

Last week we wrote: "The

A-D line is at very strong support

levels. If they hold it would add

weight to a bottom occurring at this

point."

This is a perfect V bottom. But perfect

V bottoms are somewhat unusual.

Just as the NDX is outperforming other

indexes, so is the A-D line for the

NDX.

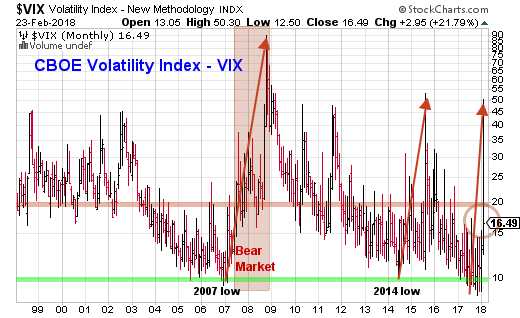

CBOE Volatility

Index (VIX).

The CBOE Volatility Index (VIX) closed

at 29.06% two weeks ago, improved to

19.46% last Friday and is now at 16.49%.

If you look at previous times that

VIX rose above 50.0 you will see that

during the weeks after there were many

VIX highs near 30-40. Only slowly did

VIX recover.

So far VIX has the one spike above

50.0 and since then it is mostly back

to normal.

It is either "different this

time" or we have not seen the

last of higher VIX readings ahead.

We extended this chart to a twenty

year time-frame to show what has occurred

every time VIX reached the 10.0 level.

A VIX 10.0 is considered by many to

be contrarian bearish, but VIX can

stay contrarian bearish for a while

once a strong rally is started.

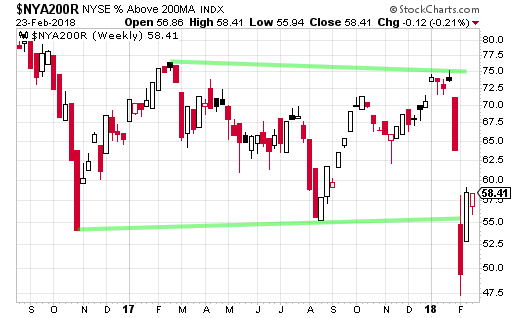

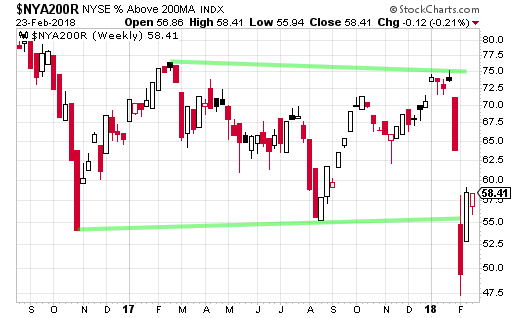

Market Internals

The number of NYSE stocks

trading back above their 200-day average

line stayed about the same, closing

Friday at 58.41%.

But this chart is still

down around its lower support level.

The coming weeks may see a great deal

of volatility in this chart.

Sentiment Indicators

These are contrarian

indicators. Typically, when advisors

are mostly bullish, the markets are

near a top.

Note that these numbers

are from a week ago. They reflect

the preceding week's sentiment.

The

number of bulls remains high. Remember

that those who are neither bullish

nor bearish have bullish positions

and really should be considered bullish.

Add bulls and those not specifically

bearish and you get 85.4%

with at least some bullish market positions.

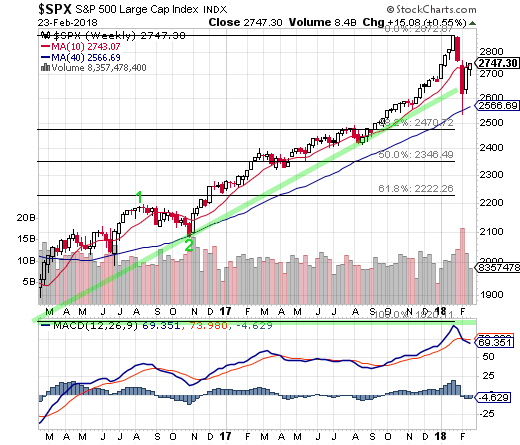

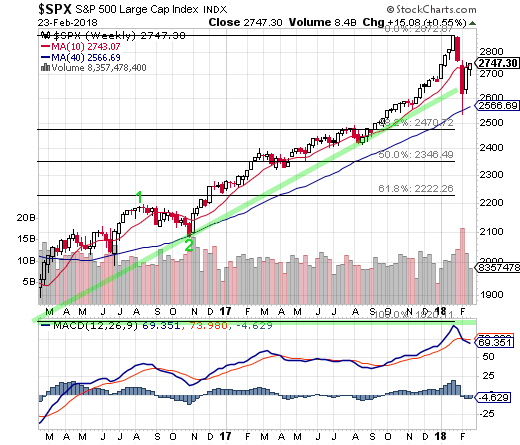

Fibonacci Support

/ Resistance Levels

We are now looking at "support

levels" from the correction lows.

Fib support levels on the weekly chart

are as follows; the 38.2% retracement

support at 2470, the 50% retracement

support at 2346 and the critical 61.8%

retracement support at 2222.

Market Moving

Economic Reports Released this Week:

As interest rates continued to rise,

purchase applications for home mortgages

fell 6.0 percent on a seasonally adjusted

basis in the February 16 week, putting

the unadjusted year-on-year gain in

the Purchase Index at 3.0 percent,

down 1 percentage point from the prior

week. Applications for refinancing,

which are even more sensitive to mortgage

rates, fell 7.0 percent from the prior

week.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

A surge in services and continued

strength in manufacturing pushed the

PMI composite to a 27-month high at

55.9 in the February flash, surprising

analysts and surpassing the Econoday

consensus range by a wide margin.

An uptick in supply and lower prices

failed to boost existing home sales

in January, which unexpectedly fell

3.2 percent versus the marginally downward

revised December to an annualized rate

of 5.380 million, well below the consensus

estimate of 5.650 million. Year-on-year,

home resales were down 4.8 percent.

Initial jobless claims continue to

post very favorable readings that remain

near historical lows, at 222,000 in

the February 17 week down 7,000 from

the previous week's downward revised

level, taking the 4-week average to

226,000, just shy of the 45-year low

seen two weeks ago.

The index of leading economic indicators

points to robust economic growth ahead,

accelerating in January to rise 1.0

percent following a 0.6 percent gain

in December. Contributing most to the

unexpectedly large gain in January

were building permits, stock prices

and once again ISM's new orders index,

where unusually strength has not yet

been translated to similar gains in

government data.

Manufacturing activity in the Kansas

City Fed's district posted very solid

growth in February, with the composite

score beating expectations by rising

1 point to 17. The production component

of the index rose 5 points to 21, as

factory activity increased particularly

for the production of metals, machinery,

and plastics.

Conclusion:

The SPX posted a substantial advance

on Friday, but for the full week had

only a + 0.55% gain.

There remains strong resistance at

about SPX 2760. This is the Fib 61.8%

retracement resistance level. A "decisive" close

above this level would likely end the

correction. But as long as this resistance

holds, we need to be careful of any

bullish entry.

We remain in cash.

The SPX portion of this

strategy is BEARISH. Aggressive traders

should be in CASH (money market funds).

S&P 500 Index (SPX) Daily Chart

S&P 500 Index (SPX), Weekly Chart

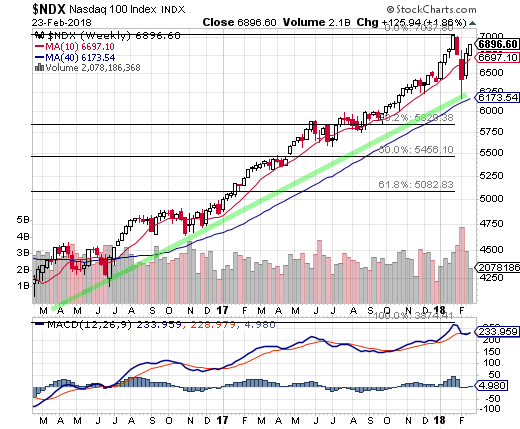

Nasdaq 100 Index (NDX) Chart Analysis

Last week we wrote:

"The Nasdaq 100 Index

(NDX) rallied this week as if a correction

had never happened in the prior weeks. The

NDX closed on Friday with a +5.58% gain. Though

the advance was powerful, we urge a bit of

caution here. The temptation to jump back in

may be strong, but when you have a selloff

as powerful as the NDX just had, it is rarely

over this quickly."

This week:

The Nasdaq 100 Index (NDX) spent most of the

week testing the Fib 61.8% retracement resistance

level. But on Friday the NDX made a decisive

close above this resistance.

That forces this portion of the strategy into

a bullish position effective Monday.

We have our concerns with the correction, worried

it is not over. "V" bottoms are not

typical. Extreme selling usually take weeks if

not months to work through before an advance

can hold.

But we must trade what is actually happening.

While the SPX and RUT remain below their resistance

levels, the NDX has made a bullish breakout.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports are

great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your investments are consumed

by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend, which

ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Maybe it really is different this time.

The Fib 61.8% resistance level is where rebounds

typically reverse. For the NDX, the breakthrough

was substantial.

We have posted Fibonacci retracement "support" levels

for the advance from the February 2016 lows. Those

Fib support levels (weekly chart)

are; 38.2% at NDX 5829, 50% at NDX 5455 and 61.8%

at NDX 5081.

Conclusion:

The NDX spent the week right at its 61.8% Fibonacci

resistance level. But on Friday that resistance

was decisively broken. This forces a bullish position

for the NDX.

The NDX portion of this strategy

is BULLISH. Aggressive traders following this strategy

should enter the below fund before the close on

Monday, February 26th.

Nasdaq 100 Index (NDX), Daily Chart

Nasdaq 100 Index (NDX), Weekly Chart

|