S&P

500 Index - SPX (50%

of Portfolio)

Entry

Date |

Signal |

Mutual

Fund

or

Index |

Entry Current

Price Price

Friday Close |

Time

Frame |

Gain

Loss |

Current

Position |

|

| 9/5/17 |

Bullish |

Rydex Nova S&P

Fd |

62.58d

- 79.28 |

9/5 - 2/9 |

+ 14.2 % |

Closed |

|

| 3/31/17 |

Bullish |

Rydex Nova S&P

Fd |

60.14 - 63.78 |

3/31 - 8/22 |

+ 6.1 % |

Closed |

|

| 1/5/17 |

Bullish |

Rydex Nova S&P

Fd |

56.54 - 60.55 |

1/5 - 3/10 |

+ 7.1 % |

Closed |

|

| 9/22/16 |

Bullish |

Rydex

Nova S&P

Fd |

51.67d

- 56.11 |

9/22

- 1/3 |

+

8.7 % |

Closed |

|

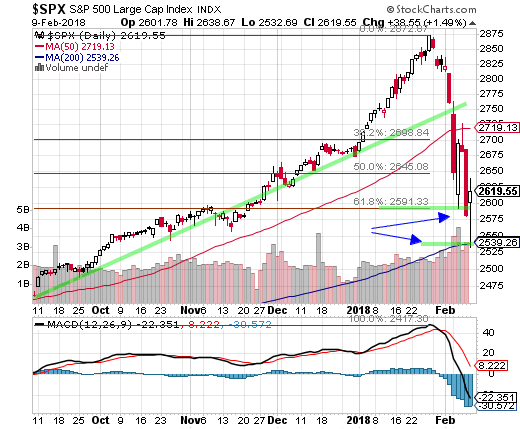

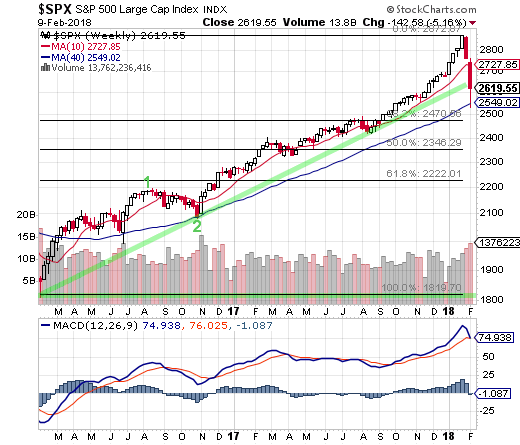

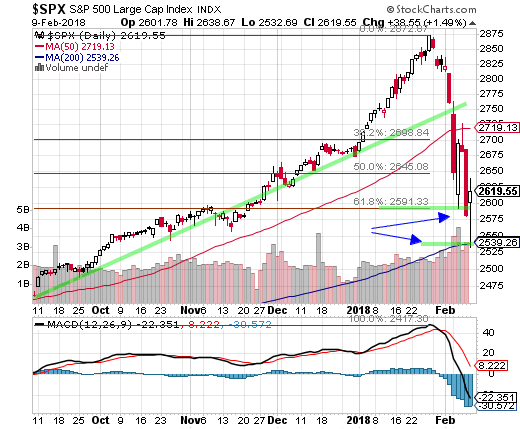

S&P 500 Index

(SPX) Chart Analysis

Last week:

"The stock market has been rising

at an unsustainable rate for most of 2017. In January

of 2018 that rise only accelerated. Although there

were reasons for the selling this week, once it started

investors and traders were quick to abandon the bull

market and exit. The S&P 500 Index (SPX) declined

- 3.85% for the full week, still not reaching a five

percent pullback which would be a minimal correction."

This week:

The intra-day lows reached on Monday during the worst

of the selling, were broken on Thursday when stocks

had another major selloff. That was the only obvious

support level that had a chance of holding in the short-term,

and it was decisively broken.

On Friday the markets opened in rally mode, but that

break in support soon weighed in and prices dropped

again, this time to new lows. Yet the volatility was

so great that the losses were erased and the S&P

managed to close with a + 1.49% gain.

That was not the case for the entire week during which

the SPX lost - 5.16%.

At this time, as scary as these declines are, we are

still looking at this as no more than a correction

in a continuing bull market.

The economy is strong and getting stronger. Jobless

numbers are at historical lows and wages are getting

better. There is no reason for a bear market at this

point.

That opinion could change of course, but for now,

even while we are almost 100% in cash positions, we

will be looking for a bottom and a reentry point.

But we do NOT see this as a "V" type correction.

The technical damage is too severe so we expect rallies

and then selling again. Possibly testing the lows and

possibly to lower lows.

Friday's decline dropped the SPX right to its 200-day

moving average line. That was apparently where many

traders had buy triggers set up because the SPX immediately

rallied.

In the daily chart of the SPX we show two support

levels. The first was at Tuesday's low. It was broken

on Thursday and Friday.

Note that this is also the 61.8% Fibonacci level (daily

chart). Though SPX 2590 was broken to the downside,

that break was fractional on Thursday and on Friday

the SPX reversed and closed higher.

The second is at the 200-day moving average line.

This is at SPX 2540. That level was reached Friday

and the stock market immediately reversed and closed

higher.

Could this be a bottom? Yes, it could. But there has

been so much damage that we are looking for a retest

of that low. If it holds again, we could see an end

to the correction. If not, well then we head lower.

While it’s impossible to say for sure what was

at work when the Dow Jones Industrial Average fell

as much as 1,597 points on Monday, the worst part of

the downdraft felt too many like machines run amok.

For 15 minutes just after 3 p.m. in New York a deluge

of sell orders came so fast that it seemed like nothing

breathing could’ve been responsible.

When something like this happens there is not much

that can be done. Basically just follow your strategies

and try not to panic.

There were two better than 9 to 1 down vs up volume

days in a row this week. Certainly not seen very often

and it was the result of panic selling. Everyone headed

for the exit at the same time.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports

are great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your investments are

consumed by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend,

which ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

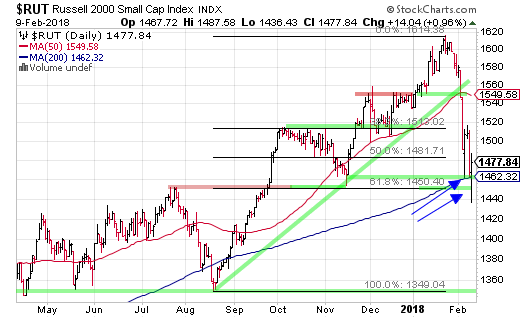

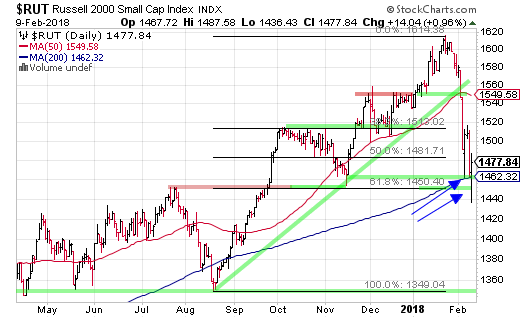

Small caps, already the weakest of the

major indexes we follow, triggered a

go-to-cash signal on Monday (executed

Tuesday).

There are two support levels for small

caps. At RUT 1462 and then at RUT 1440.

Both were hit this week but small caps

rebounded, closing the week at RUT 1477.

This has the look of a reversal at a

bottom. But it is far too soon to take

any chance at reentry.

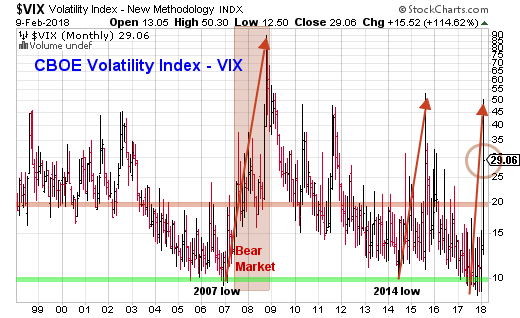

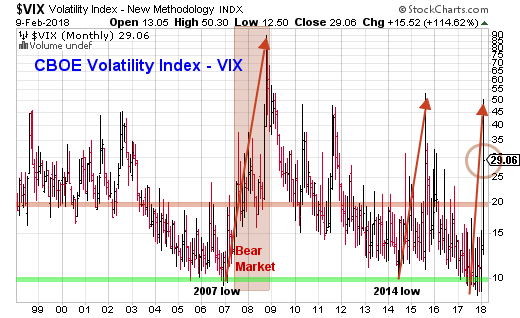

During extreme volatility on Monday,

the CBOE Volatility Index (VIX) rose

to just above 50.0.

We have been calling for this move for

months, but certainly did not expect

it to occur in a single week. The VIX

is up + 114% in February. At its highs,

VIX was up over +300%.

Note that VIX extremes in the past resulted

in market bottoms. So the VIX chart could

be very good news.

Regularly

Followed Weekly Charts

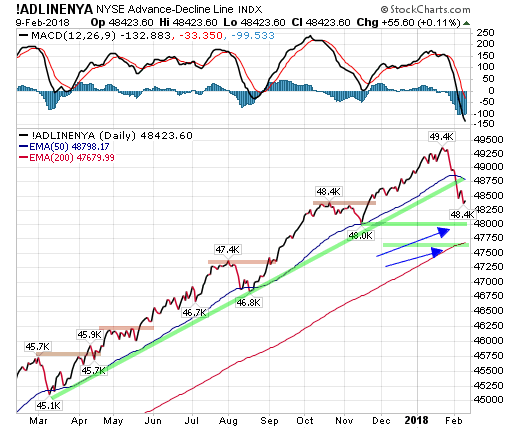

NYSE Advance-Decline

Line

The NYSE Advance-Decline line took a

steep drop this week. The selling took

the A-D line down to well below its rising

trend support line.

The A-D line also closed below its 50-day

moving average line and MACD has turned

decisively lower.

We have two potential support levels

on the below chart.

The first is at the November 2017 lows

and the second at the 200-day moving

average line.

Either could stop the freefall, or we

could be at a bottom now after several

of the major indexes hit their 200-day

averages and then rebounded.

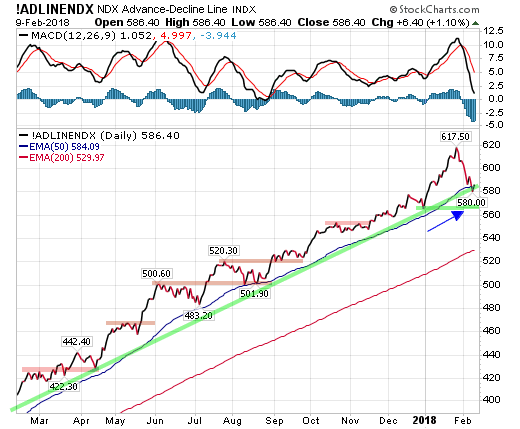

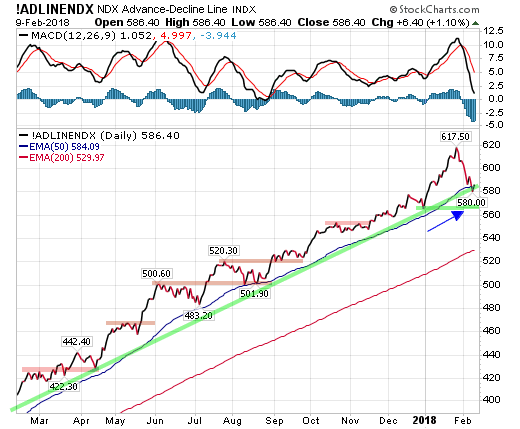

The Nasdaq 100 Index Advance-Decline

Line decline hit its rising trend support

line this week. That line is also at

the same level as its 50-day moving average.

The A-D line is at very strong support

levels. If they hold it would add weight

to a bottom occurring at this point.

If we go lower, the next support is

down at the December 2017 lows.

MACD has suffered a bearish crossover.

CBOE Volatility

Index (VIX).

The CBOE Volatility Index (VIX) closed

at 29.06% on Friday. This was a 68% gain

for the week as traders began buying

more insurance against further declines.

We covered this chart in the above report.

The gains are so extreme, over 50.0 at

the highs, it could be indicating a bottom

is at hand or is very close.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing the markets

successfully for over 25 years.

Join us and start

winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

We extended this chart to a twenty

year time-frame to show what has occurred

every time VIX reached the 10.0 level.

A VIX 10.0 is considered by many to

be contrarian bearish, but VIX can

stay contrarian bearish for a while

once a strong rally is started.

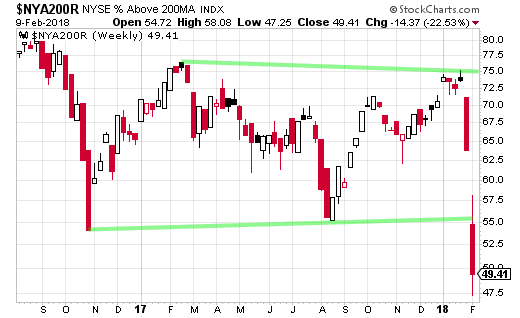

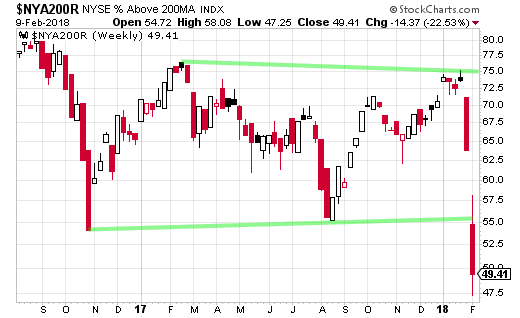

Market Internals

As would be expected

considering the selloff, the number

of NYSE stocks above their 200-day

moving averages declined precipitously

From 75% of stocks above

their 200-day average two weeks ago

to only 49% now.

Sentiment Indicators

These are contrarian

indicators. Typically, when advisors

are mostly bullish, the markets are

near a top.

Note that these numbers

are from a week ago. They reflect

the preceding week's sentiment.

The

number of bulls remains high. Remember

that those who are neither bullish

nor bearish have bullish positions

and really should be considered bullish.

Add bulls and those not specifically

bearish and you get 84.5%

with at least some bullish market positions.

Investor's

Intelligence Bull vs. Bears as

of Jan 30, show 54.4%

bullish vs. 15.5% bearish.

Bull vs. Bears last week were 66.0%

bullish vs. 12.6% bearish.

** as these

numbers are a week old, we will be looking

for a much higher percent of bears when

next reported.

-

Barron's Magazine

Consensus Index shows 73% bullish

vs. 77% bullish the previous

week.

-

Market

Vane's Bullish Consensus

shows 64% are bullish

vs. 70% bullish the

week before.

Fibonacci Support

/ Resistance Levels

We are now looking at "support

levels" from the correction lows.

Fib support levels on the weekly chart

are as follows; the 38.2% retracement

support at 2470, the 50% retracement

support at 2346 and the critical 61.8%

retracement support at 2222.

Market Moving

Economic Reports Released this Week:

Growth in the services PMI held at

a moderate 53.3 in the final reading

for January, a 9-month low and unchanged

from the mid-month flash and down 4

tenths from December.

The U.S. trade deficit in December

and for the full year both rose to

the highest levels since 2008, complicating

efforts by President Trump to fulfill

his vow to reduce the gap. The deficit

in December rose 5.3% to $53.1 billion,

the Commerce Department said Tuesday.

Consumer borrowing increased in December,

up $18.4 billion vs an upwardly revised

$31.0 billion in November which is

the largest monthly increase since

a break in the series 7 years ago.

Revolving credit, a component that

tracks credit-card debt, rose a sizable

$5.1 billion following a November spike

of $11.0 billion. On an annualized

basis, revolving credit rose at a 6.0

percent pace in December.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates

Every Trading

Day

These

FREE reports are NOT enough

Receive our reports in Real-Time!

only

$12.25 monthly

Available

this Weekend

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your

investments are

consumed by a volatile

Wall Street?

Consider Fibtimer's

trend trading services.

Our trading plans

are unemotional

and are always

invested with the

trend, which ever

way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in

BOTH advancing & declining

markets. No more

sleepless nights.

No more upset

stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to

new subscribers.

---

Available ONLY This

Weekend - only

$12.25 monthly

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

Initial U.S. jobless claims fell by

9,000 to 221,000 in the seven days

ended Feb 3. Economists surveyed by

MarketWatch forecast a 235,000 reading.

The more stable monthly average of

claims declined by 10,000 to 224,500,

the government said Thursday. That’s

the lowest level since March 1973.

Moody's Threatens US Downgrade Due

To Soaring Debt, Fiscal Deterioration. "The

stable credit profile of the United

States (Aaa stable) is likely to face

downward pressure in the long-term,

due to meaningful fiscal deterioration

amid increasing levels of national

debt and a widening federal budget

deficit"

Conclusion:

The SPX traded in wild swings this

week as computers took the major indexes

for a ride. Extreme ups and downs in

the range of 1000 Dow points were every

day events.

This strategy went to cash on Tuesday,

a rally day, but we could already have

reached a correction bottom at SPX

2540 as discussed in the above report.

We will find out next week.

The SPX portion of this

strategy is BEARISH. Aggressive traders

should be in CASH (money market funds).

S&P 500 Index (SPX) Daily Chart

S&P 500 Index (SPX), Weekly Chart

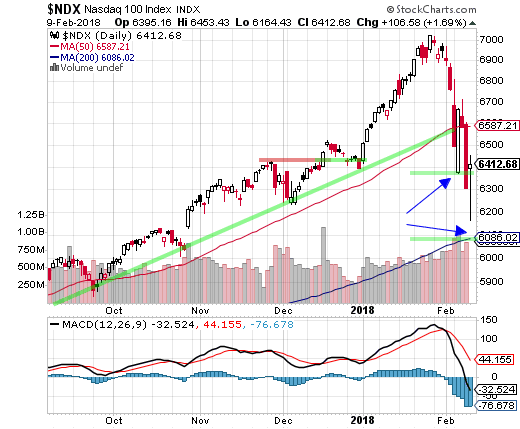

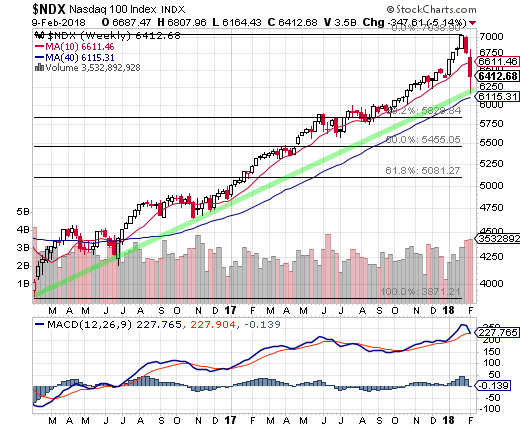

Nasdaq 100 Index (NDX) Chart Analysis

Last week we wrote:

"This long-term chart

does not look as bad as the week felt. Looking

with a long term view we would have to say

that yes it was a bad week, but the uptrend

has not been broken. When you have strong gains

in the first days of the New Year it usually

means you will have a positive year ahead"

This week:

On the weekly chart below, the Nasdaq 100 Index

(NDX) only just touched its long-term (2 years)

rising trend support line before reversing higher

on Friday.

That one chart could be showing us that a bottom

has been reached.

But considering the volatility, the risk is

far too high at this point for any bullish entry.

Four percent swings happening in minutes is too

risky for us.

The 200-day moving average line has not yet

been reached.

|

Fibtimer HALF

PRICE Offer!

Get

Our Full Reports

Every Weekend

plus Updates Every Trading Day

These FREE reports are

great, but getting our timing signals daily is

what you need to beat the market!

only

$12.25 monthly for

full year

Bull & Bear

Timer

10 Year Results

Fibtimer Timing + 288.9 % |

3

Year Results

Fibtimer Timing + 59.2 %

|

1

Year Results

Fibtimer Timing + 35.5.%

|

Sleepless

nights as your investments are consumed

by a volatile Wall Street?

Consider Fibtimer's

trend trading services. Our trading

plans are unemotional and are always

invested with the trend, which

ever way it is headed.

Fibtimer's

timing strategies MAKE

MONEY in BOTH advancing & declining

markets. No more sleepless nights.

No more upset stomachs.

We profit year after year after year. In fact, we have been timing

the markets successfully for over 25 years.

Join us and start winning!

We

are currently offering HALF

PRICE to new and returning

subscribers.

--- only

$12.25 monthly for full year

Special

HALF PRICE Offer - CLICK

HERE NOW

|

|

In the daily chart we have two support levels

drawn. The first is at about NDX 6370. That support

was broken intra-day on Friday but has apparently

held after the NDX rebounded.

The second is at the 200-day moving average line,

around NDX 6086.

Remember that a rally early next week could be

followed by another major selloff. It is not safe

to bet on the bullish side yet.

MACD on the daily chart has posted a bearish crossover.

MACD closed this week at -32.52. A huge one-week

decline.

MACD on the less volatile weekly chart of the

NDX closed at + 227.76.

We have posted Fibonacci retracement "support" levels

for the advance from the February 2016 lows. Those

Fib support levels (weekly chart)

are; 38.2% at NDX 5829, 50% at NDX 5455 and 61.8%

at NDX 5081.

Conclusion:

As we wrote last week, the NDX had risen during

the first four weeks of 2018 and had done so in

a nearly parabolic fashion.

That resulted in the parabolic selloff we just

endured.

For those who think such a selloff could be timed,

remember that if there were clues to this selloff,

it would just have occurred earlier.

Also, if knowing this was going to eventually

happen kept us in cash over past months that would

have just killed any chance of the gains we did

realize.

The NDX portion of this strategy

is BEARISH. Aggressive traders should be in CASH

(money market funds).

Nasdaq 100 Index (NDX), Daily Chart

Nasdaq 100 Index (NDX), Weekly Chart

|